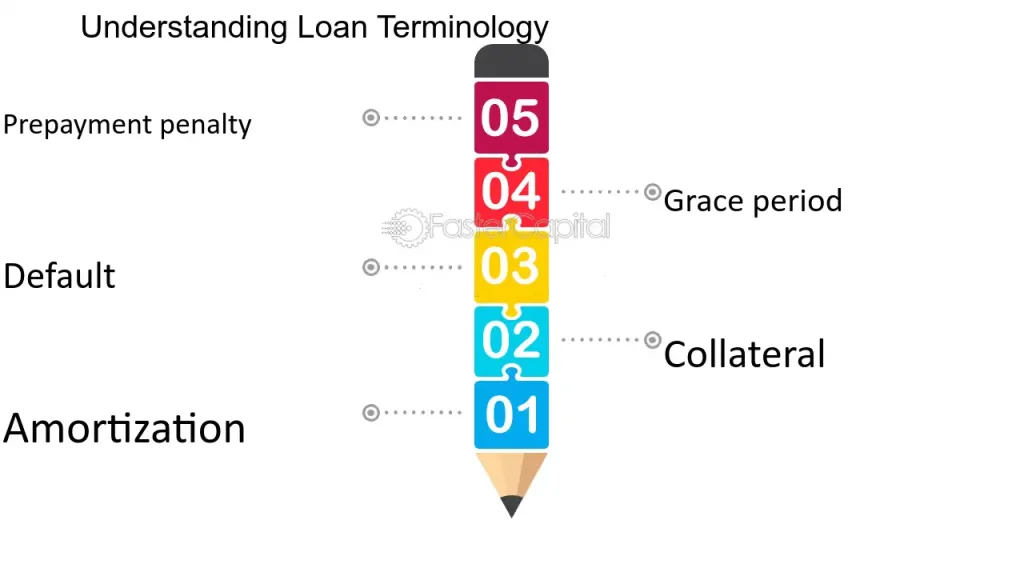

**Understanding Loan Terminology**: Loan terminology encompasses the terms and conditions associated with borrowing money, including repayment periods, interest rates, and fees. Familiarity with these terms helps borrowers make informed financial decisions.

Navigating the world of loans can be daunting, especially with the array of terminology involved. Understanding loan terminology is essential for anyone looking to borrow money. Knowledge of terms like principal, interest rate, and repayment period can empower borrowers to negotiate better deals.

Each loan comes with its unique set of conditions that can significantly impact your financial situation. By grasping these concepts, you can avoid common pitfalls and make sound borrowing choices. This blog will clarify key loan terms, ensuring you feel confident in your financial decisions.

Demystifying Loan Terms

Understanding loan terminology is crucial for making informed financial decisions. Loan terms can seem complex. Knowing these terms can help you avoid pitfalls. This section breaks down key components of loans and provides insights into interest rates.

Key Components Of A Loan

Loans have several important components. Each plays a role in how loans work. Here are the key elements:

- Principal: The original amount borrowed.

- Interest Rate: The cost of borrowing money, expressed as a percentage.

- Loan Term: The duration over which the loan must be repaid.

- Fees: Additional costs that may apply, such as processing fees.

- Collateral: An asset pledged to secure the loan.

| Component | Description |

|---|---|

| Principal | The initial sum borrowed. |

| Interest Rate | Percentage charged on the principal. |

| Loan Term | Timeframe for repayment. |

| Fees | Extra charges for processing the loan. |

| Collateral | Asset used to secure the loan. |

Interest Rate Insights

The interest rate is a key factor in any loan. It affects how much you pay over time. Here are some important points:

- Fixed Rate: The rate stays the same throughout the loan.

- Variable Rate: The rate can change based on market conditions.

- APR: Annual Percentage Rate includes interest and fees.

Understanding these types of interest rates helps you make better choices. Here’s a quick comparison:

| Type | Description | Pros | Cons |

|---|---|---|---|

| Fixed Rate | Rate remains constant. | Predictable payments. | Higher initial rates. |

| Variable Rate | Rate may fluctuate. | Potentially lower initial rates. | Unpredictable payments. |

Credit: fastercapital.com

Principal Amount Explained

The principal amount is the sum of money borrowed from a lender. It forms the basis of any loan. Understanding this term is crucial for managing your finances effectively. The principal amount does not include interest or fees. Knowing how the principal works helps in planning repayments.

Borrowing Basics

When you take a loan, you agree to pay back the principal amount plus interest. Here are some key points to understand:

- The principal is the original loan amount.

- Interest is calculated on the principal.

- Loans can have fixed or variable interest rates.

- Understanding your principal helps in budgeting.

| Loan Type | Principal Amount | Interest Rate |

|---|---|---|

| Personal Loan | $10,000 | 5% |

| Home Loan | $200,000 | 3.5% |

| Car Loan | $25,000 | 6% |

Repaying The Principal

Repaying the principal is an important part of your loan agreement. Here are some essential aspects:

- Make regular payments to reduce the principal.

- Pay extra when possible to lower interest costs.

- Know your repayment schedule.

- Consider refinancing options if needed.

It is important to track your payments. This helps in understanding how much principal remains. The faster you pay down the principal, the less interest you will pay overall.

Interest Rates And How They Work

Understanding interest rates is crucial for managing loans. Interest rates determine how much you pay back on a loan over time. They can vary widely based on different factors. Knowing how interest rates work helps you make informed financial decisions.

Types Of Interest Rates

There are two main types of interest rates: fixed and variable.

- Fixed Interest Rate: This rate remains the same throughout the loan period. Your monthly payments stay consistent.

- Variable Interest Rate: This rate can change based on market conditions. Monthly payments may increase or decrease over time.

Here is a table summarizing the differences:

| Type | Description | Payment Stability |

|---|---|---|

| Fixed | Rate stays the same | Stable |

| Variable | Rate may change | Unstable |

Calculating Your Interest

Calculating interest helps you understand your loan costs. Here’s a simple way to calculate your interest:

- Identify the principal amount (the initial loan amount).

- Determine the interest rate (annual percentage rate).

- Decide the loan term (how long you will have the loan).

- Use the formula: Interest = Principal x Rate x Time.

For example, if you borrow $1,000 at a 5% interest rate for 3 years:

Interest = $1000 x 0.05 x 3 = $150Your total repayment amount would be $1,150.

Understanding these concepts helps in choosing the right loan. Always read the terms carefully before signing.

Credit: fastercapital.com

Apr Vs. Interest Rate

Understanding the difference between APR and interest rate is crucial for borrowers. Both terms relate to how much you will pay for a loan. However, they represent different costs. Knowing these differences can help you make better financial decisions.

Understanding Apr

APR stands for Annual Percentage Rate. It reflects the total cost of borrowing over a year. This includes not just the interest rate, but also any additional fees. These fees might include:

- Loan origination fees

- Closing costs

- Any other charges required to secure the loan

APR provides a broader view of what you will pay. It helps in comparing different loans. A lower APR usually means a better deal.

Comparing Apr And Interest Rates

Understanding the differences can help you save money. Here’s a comparison:

| Feature | APR | Interest Rate |

|---|---|---|

| Definition | Total cost of borrowing | Cost of borrowing only |

| Includes Fees | Yes | No |

| Comparison Tool | Yes | No |

Remember these key points:

- APR includes all costs.

- Interest rate is just the cost of borrowing.

- Use APR to compare loans effectively.

By understanding these terms, you can make smarter choices. Always check both the APR and interest rate before deciding on a loan.

Loan Fees And Charges

Understanding loan fees and charges is crucial for borrowers. These costs can significantly impact the total amount paid over time. Knowledge of these fees helps avoid surprises and ensures informed financial decisions. Let’s explore the common fees and how to avoid hidden charges.

Common Loan Fees

Loan fees can vary by lender and loan type. Here are some common fees you might encounter:

| Fee Type | Description |

|---|---|

| Origination Fee | This fee covers the lender’s costs to process the loan. |

| Application Fee | Charged for submitting a loan application. |

| Underwriting Fee | Pays for the risk assessment of the loan. |

| Prepayment Penalty | Fee for paying off the loan early. |

| Late Payment Fee | Charged if payment is made after the due date. |

Avoiding Hidden Charges

Hidden charges can sneak up on borrowers. To avoid them, follow these tips:

- Read the Fine Print: Always read the loan agreement thoroughly.

- Ask Questions: Clarify any terms or fees you don’t understand.

- Compare Lenders: Look at different lenders to find the best deal.

- Negotiate Fees: Some fees may be negotiable, so ask.

- Check for Discounts: Some lenders offer discounts for automatic payments.

Understanding loan fees and charges helps you make better financial choices. Stay informed and protect your wallet.

The Four C’s Of Credit

Understanding the Four C’s of Credit is vital for loan approval. These components help lenders evaluate potential borrowers. The Four C’s are:

- Credit History

- Capacity to Repay

- Capital

- Collateral

In this section, we will focus on the first two C’s: Credit History and Capacity to Repay.

Credit History

Credit history shows how you have managed debt in the past. It includes:

- Payment history

- Credit card usage

- Loan types

- Public records

Lenders review your credit report. A good credit score indicates reliability. A low score may lead to higher interest rates or denial.

Here are important factors affecting your credit history:

| Factor | Impact on Credit Score |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Length of Credit History | 15% |

| Types of Credit | 10% |

| Recent Inquiries | 10% |

Capacity To Repay

Capacity to repay measures your ability to pay back the loan. Lenders assess your income and expenses. They want to know if you can handle extra monthly payments.

Key elements of capacity include:

- Monthly income

- Current debts

- Employment stability

To calculate your capacity, lenders often use the debt-to-income (DTI) ratio. This ratio compares your monthly debt to your gross monthly income.

A lower DTI ratio is better. It suggests you can manage your debts without strain. Here’s how to calculate it:

DTI = (Total Monthly Debt Payments / Gross Monthly Income) x 100A DTI of 36% or lower is often preferred by lenders.

Loan Repayment Terms

Understanding loan repayment terms is essential for borrowers. These terms outline how and when you will pay back your loan. Knowing the details can save you money and help avoid surprises. Key concepts include the repayment period and any prepayment penalties.

Repayment Period

The repayment period is the time frame in which you must repay your loan. This period can vary widely, impacting your monthly payments and total interest costs. Here are common repayment periods:

- Short-term loans: Typically 1 to 3 years

- Medium-term loans: Generally 3 to 5 years

- Long-term loans: Usually 10 years or more

Shorter repayment periods mean higher monthly payments but less total interest. Longer periods offer lower payments but increase total interest costs. Always choose a period that fits your financial situation.

Prepayment Penalties

Prepayment penalties are fees charged if you pay off your loan early. Not all loans have these penalties, but they can affect your decision. Here are key points to consider:

| Loan Type | Prepayment Penalty |

|---|---|

| Fixed-rate mortgage | May have a penalty |

| Variable-rate mortgage | Usually no penalty |

| Personal loan | Varies by lender |

Check your loan agreement for any prepayment penalties. Understanding these can help you save money if you plan to pay off your loan early.

Credit: www.fortpittcapital.com

Loan Amortization Demystified

Understanding loan amortization is crucial for borrowers. It helps you grasp how loan payments work over time. Amortization breaks down your loan into manageable payments. This process impacts your total interest paid and loan duration.

Amortization Schedules

An amortization schedule details each payment during the loan term. It shows how much goes to principal and interest. Here’s a simple breakdown:

| Payment Number | Payment Amount | Principal Paid | Interest Paid |

|---|---|---|---|

| 1 | $1,000 | $800 | $200 |

| 2 | $1,000 | $810 | $190 |

| 3 | $1,000 | $820 | $180 |

Each payment reduces the loan balance. This makes it easier to track your debt. You can see how much you owe after each payment.

Benefits Of Amortization

- Predictable Payments: Know exactly what to pay each month.

- Less Interest Over Time: Pay down principal faster with each payment.

- Financial Planning: Helps in budgeting for future expenses.

- Equity Growth: Build equity as you pay down the loan.

Amortization provides clarity in financial planning. Understanding this process can save you money. It helps you make informed decisions about your loans.

Secured Vs. Unsecured Loans

Understanding the difference between secured and unsecured loans is essential. These terms refer to how lenders protect their investment. Knowing these differences can help you choose the right loan for your needs.

Collateral For Secured Loans

A secured loan requires collateral. Collateral is an asset that the lender can claim if you don’t repay the loan. Common types of collateral include:

- Real estate

- Vehicles

- Bank accounts

- Jewelry

Here are key points about secured loans:

| Feature | Details |

|---|---|

| Interest Rates | Usually lower due to reduced risk |

| Loan Amount | Often higher based on collateral value |

| Risk | Risk of losing collateral if you default |

Understanding Unsecured Loans

Unsecured loans do not require collateral. This means the lender cannot claim any of your assets if you fail to repay. Common types include:

- Personal loans

- Credit cards

- Student loans

Consider these aspects of unsecured loans:

- Interest Rates: Generally higher due to increased risk.

- Loan Amount: Usually lower compared to secured loans.

- Repayment Terms: Flexible but may vary by lender.

Both loan types have their pros and cons. Choose based on your financial situation and risk tolerance.

Negotiating Loan Terms

Negotiating loan terms can make a significant difference in your financial future. Understanding key terminology helps you approach lenders with confidence. You can secure better rates and terms by using effective negotiation strategies.

Tips For Better Terms

- Research: Know the average interest rates for your loan type.

- Check your credit score: A higher score often leads to better terms.

- Prepare documents: Have all necessary paperwork ready to show your financial status.

- Be clear about your needs: Know what terms work best for you.

- Stay calm: Keep a cool head during negotiations.

Negotiation Strategies

Using the right strategies can enhance your chances of getting favorable terms. Here are some effective methods:

- Start low: Begin with a lower offer than you expect.

- Use competition: Mention offers from other lenders.

- Ask for flexibility: Inquire about waiving fees or adjusting the rate.

- Be ready to walk away: Show you have other options if needed.

- Follow up: Don’t hesitate to revisit negotiations if needed.

| Strategy | Description |

|---|---|

| Start Low | Begin your negotiation with a lower offer. |

| Use Competition | Reference offers from different lenders. |

| Ask for Flexibility | Request adjustments to fees or rates. |

| Be Ready to Walk Away | Indicate you have other options available. |

| Follow Up | Revisit negotiations if necessary. |

Implementing these tips and strategies can lead to better loan terms. Always approach negotiations with a clear understanding of your financial needs and goals.

Credit: agilecap.com

Frequently Asked Questions

How To Understand Loan Terms?

To understand loan terms, read the loan agreement thoroughly. Focus on key elements like interest rates, repayment periods, and fees. Ask questions for clarity. Use online resources or financial advisors for guidance. Familiarize yourself with common terminology to make informed decisions.

What Are The 4 C’s In Loan?

The four C’s in loans are capacity, capital, collateral, and credit. Lenders assess these factors to determine a borrower’s eligibility. Capacity measures income and ability to repay. Capital refers to the borrower’s assets. Collateral includes valuables pledged against the loan.

Credit assesses the borrower’s credit history.

What Is The Basic Understanding Of Loans?

A loan is borrowed money that individuals or businesses must repay with interest. Borrowers agree to specific terms, including repayment schedules and interest rates. Loans help manage both planned and unexpected expenses, creating a debt obligation until fully paid. Understanding these basics is crucial for responsible borrowing.

What Are The Basic Concepts Of Loans?

Loans are borrowed sums of money that require repayment with interest. Key concepts include principal, interest rate, repayment period, and associated fees. Borrowers must understand terms and conditions before accepting a loan, as these dictate repayment obligations and potential penalties.

Always evaluate loan options carefully.

Conclusion

Grasping loan terminology is essential for making informed financial decisions. Understanding terms like interest rates, repayment periods, and fees can empower you as a borrower. With this knowledge, you can negotiate better deals and avoid potential pitfalls. Equip yourself with the right information to navigate the lending landscape confidently.