Artificial Intelligence (AI) is revolutionizing fintech by enhancing efficiency and accuracy in financial services. It streamlines operations, improves customer experience, and mitigates risks through advanced data analysis.

The integration of Artificial Intelligence in fintech is transforming how financial services operate. AI technologies enable personalized banking experiences, improve fraud detection, and automate complex processes like credit scoring. This shift not only enhances customer engagement but also provides businesses with valuable insights for strategic decision-making.

As fintech companies embrace AI, they can innovate their offerings and cater to diverse customer needs more effectively. With the power of machine learning and data analytics, the financial landscape is evolving rapidly, positioning AI as a crucial component in driving future growth and competitiveness in the industry.

AI: A Catalyst In Fintech

Artificial Intelligence is changing the world of finance. It acts as a powerful catalyst, driving innovation and improving services. AI enhances efficiency and ensures better decision-making. This transformation is evident across various financial sectors.

The Fusion Of Ai And Finance

The integration of AI in finance creates a dynamic landscape. It combines technology with traditional financial practices. This fusion leads to increased productivity and smarter operations.

- Data Analysis: AI processes vast amounts of data quickly.

- Predictive Analytics: It forecasts trends and customer behavior.

- Risk Management: AI identifies potential risks faster.

Many companies now utilize AI to enhance their services. It allows for personalized financial solutions that cater to individual needs.

Reshaping Customer Experiences

AI transforms how customers interact with financial services. It creates a seamless and personalized experience. Here are some key changes:

| Feature | Traditional Approach | AI-Driven Approach |

|---|---|---|

| Customer Service | Standardized responses | Personalized assistance |

| Fraud Detection | Manual monitoring | Real-time alerts |

| Investment Advice | Generic recommendations | Tailored strategies |

Customers enjoy faster responses and tailored solutions. This enhances satisfaction and builds trust in financial institutions.

AI not only improves efficiency but also enhances security. It protects sensitive financial data from threats.

As AI continues to evolve, it will reshape the financial landscape further. The future looks bright for fintech.

AI-driven Personalization

Artificial Intelligence reshapes how financial services connect with customers. It offers tailored experiences that meet individual needs. This personalization improves customer satisfaction and loyalty. Companies leverage AI to provide unique solutions, making finance feel more personal.

Customized Financial Advice

AI analyzes vast amounts of data quickly. It helps create personalized financial plans. Customers receive advice based on their unique financial situations. This leads to better investment choices and savings strategies.

- Real-time financial analysis

- Personalized investment recommendations

- Goal-based savings plans

Tools like robo-advisors use AI for this purpose. They assess risk tolerance and investment goals. Clients can adjust their plans as needed, ensuring adaptability.

Enhanced Customer Service

AI transforms customer service in fintech. Chatbots provide instant responses to inquiries. They operate 24/7, ensuring help is always available. This speeds up resolution times and enhances user experience.

| Customer Service Features | Benefits |

|---|---|

| 24/7 Availability | Assistance anytime, day or night |

| Instant Responses | Quick resolution of common queries |

| Personalized Interactions | Tailored support based on user data |

AI also tracks user interactions. It learns from these to improve future responses. This continuous learning enhances customer satisfaction.

Revolution In Fraud Detection

The rise of Artificial Intelligence (AI) is changing the game in fraud detection. Traditional methods struggle to keep up with evolving threats. AI systems analyze vast amounts of data quickly. They spot unusual patterns that human eyes might miss. This capability leads to more effective prevention of financial crimes.

Ai In Combating Financial Crimes

AI technologies are key players in the fight against fraud. They utilize machine learning and advanced algorithms to detect suspicious activities. Here’s how AI combats financial crimes:

- Real-time monitoring: AI systems analyze transactions as they occur.

- Behavioral analysis: AI learns customer behavior to spot anomalies.

- Pattern recognition: AI identifies trends in fraud attempts.

- Automated alerts: AI sends alerts for immediate investigation.

These features significantly reduce the risk of fraud. Financial institutions can act faster, protecting their customers better.

Improving Security Measures

AI enhances security measures in various ways:

| Security Measure | AI Contribution |

|---|---|

| Data Encryption | AI ensures stronger encryption methods. |

| Identity Verification | AI improves accuracy in identity checks. |

| Transaction Analysis | AI monitors transactions for irregularities. |

| Risk Assessment | AI evaluates risks using predictive modeling. |

By adopting these AI-driven measures, firms can secure their operations. Customers feel safer knowing their finances are protected.

Automated Financial Operations

Artificial Intelligence is revolutionizing fintech by automating financial operations and enhancing accuracy. This technology streamlines processes, improves customer service, and boosts fraud detection. As AI continues to evolve, it shapes a more efficient and responsive financial landscape, driving innovation across the industry.

Automated financial operations are changing how we manage money. AI tools streamline processes, reduce human error, and save time. This transformation is crucial for both banks and customers. It enhances efficiency and makes financial services more accessible.

Credit Scoring And Loan Processing

AI plays a vital role in credit scoring and loan processing. Traditional methods often rely on limited data. AI uses vast amounts of information to assess creditworthiness. Here’s how:

- AI analyzes credit history and financial behavior.

- It identifies patterns that predict repayment ability.

- Machine learning models improve over time, increasing accuracy.

Benefits include:

| Benefits | Description |

|---|---|

| Faster Decisions | AI provides quick loan approvals. |

| Reduced Bias | AI minimizes human bias in lending. |

| Better Risk Management | AI predicts risks more effectively. |

These advancements help more people access loans. They make financial systems fairer and more efficient.

Streamlining Bank Account Operations

AI also streamlines bank account operations. Customers expect quick and reliable services. AI tools automate many of these tasks, such as:

- Account opening and verification

- Transaction monitoring for fraud detection

- Personalized customer service through chatbots

Key advantages include:

- 24/7 customer support availability.

- Instant transaction alerts for better security.

- Improved customer experience with tailored services.

Through automation, banks enhance operational efficiency. This leads to satisfied customers and growth in the financial sector.

Predictive Analytics In Finance

Predictive analytics is changing the finance industry. It uses data to forecast future trends. This technology helps businesses make smart decisions. Financial institutions can analyze large data sets quickly. They identify patterns and predict outcomes with high accuracy. This leads to better investment strategies and risk management.

Investment Predictions

Investment predictions are crucial for success in finance. Predictive analytics enables investors to foresee market trends. It provides valuable insights into stock performance and economic changes. Here are some key benefits:

- Data-Driven Decisions: Investors rely on accurate data.

- Market Timing: Predictive models help in timing investments.

- Portfolio Management: Optimize asset allocation based on predictions.

For example, a predictive model can analyze historical data. It can forecast future stock price movements. This helps investors make informed choices.

Risk Assessment And Management

Risk assessment is essential in finance. Predictive analytics improves risk management. It helps institutions identify potential risks early. Here are some key aspects:

| Risk Type | Predictive Analytics Role |

|---|---|

| Credit Risk | Analyze borrower data to assess repayment ability. |

| Market Risk | Forecast market fluctuations based on trends. |

| Operational Risk | Identify process failures and inefficiencies. |

Using predictive analytics allows financial institutions to minimize losses. It enhances their ability to respond to market changes. This leads to improved decision-making and better customer trust.

Credit: appinventiv.com

AI In Investment Management

AI in Investment Management is reshaping how investors make decisions. With advanced algorithms, AI analyzes vast amounts of data quickly. It provides insights that were previously hard to achieve. Investors can now access personalized strategies that align with their goals.

Robo-advisors In The Market

Robo-advisors are automated platforms that manage investments. They use AI to create tailored portfolios for users. Here are some key features of robo-advisors:

- Low fees compared to traditional advisors.

- Access to sophisticated algorithms.

- 24/7 availability for account management.

Many robo-advisors also offer:

- Automated rebalancing to maintain asset allocation.

- Tax-loss harvesting to enhance returns.

- Personalized financial planning tools.

Examples of popular robo-advisors include:

| Robo-Advisor | Key Feature |

|---|---|

| Wealthfront | Automated financial planning |

| Betterment | Tax-loss harvesting |

| Schwab Intelligent Portfolios | No advisory fees |

Strategic Asset Allocation

Strategic asset allocation is crucial for investment success. AI helps in determining the best mix of assets. It considers various factors, such as:

- Market trends.

- Risk tolerance.

- Investment goals.

AI models analyze historical data to predict future performance. This allows investors to adjust portfolios based on real-time insights. Benefits of AI in asset allocation include:

- Improved accuracy in predictions.

- Quick adjustments to market changes.

- Enhanced risk management strategies.

Investors leveraging AI can navigate complex markets more effectively. This technology transforms traditional approaches into smarter, data-driven decisions.

Challenges And Ethical Considerations

The rise of Artificial Intelligence (AI) in fintech brings exciting advancements. Yet, it also introduces significant challenges. Ethical considerations are vital as we navigate this new landscape. Two major concerns stand out: data privacy and algorithmic discrimination.

Data Privacy Concerns

Data privacy is a critical issue in the fintech space. AI systems rely heavily on vast amounts of personal data. This raises questions about how this data is collected and used.

- Consent: Are users fully informed about data usage?

- Security: How is sensitive information protected?

- Transparency: Are AI decision-making processes clear to users?

Companies must ensure they comply with regulations. These include the GDPR and CCPA. Failing to do so can lead to severe penalties. Trust is essential for customer retention.

Algorithmic Discrimination And Biases

AI systems can unintentionally perpetuate existing biases. This can lead to unfair treatment of certain groups. For example, biased algorithms may affect credit scoring.

| Risk Area | Potential Impact |

|---|---|

| Credit Scoring | Disadvantage to minority applicants |

| Loan Approvals | Exclusion of low-income individuals |

| Insurance Premiums | Higher rates for specific demographics |

Addressing these biases is crucial. Regular audits of AI algorithms can help. Companies must prioritize fairness and accountability in their systems.

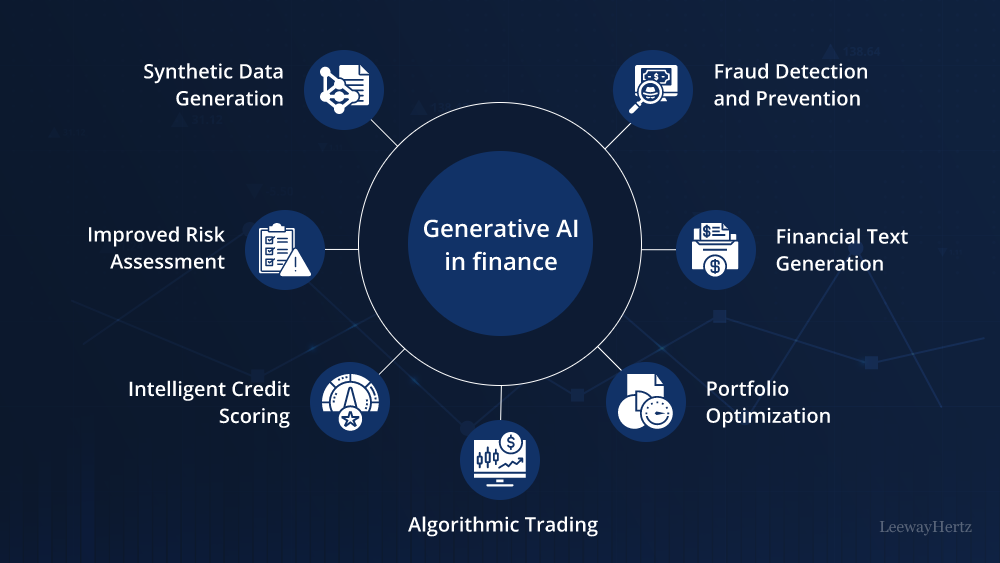

Credit: www.leewayhertz.com

Future Of AI In Fintech

The future of Artificial Intelligence (AI) in fintech looks bright. AI is set to reshape how financial services operate. It enhances efficiency and customer experience. This technology will drive innovation and create new opportunities. Understanding its potential is essential for stakeholders.

Innovation And Growth Prospects

AI is a game changer for the fintech industry. It brings various innovations, which include:

- Personalized services: AI analyzes user data to tailor financial products.

- Fraud detection: Machine learning algorithms identify suspicious activities.

- Automated processes: AI streamlines tasks like credit scoring and compliance.

Growth prospects are vast. The global AI in fintech market is projected to reach:

| Year | Market Value (in billion USD) |

|---|---|

| 2023 | 10.4 |

| 2025 | 20.5 |

| 2030 | 50.4 |

This growth indicates a strong demand for AI solutions. Companies must adapt to stay competitive.

Skills And Employment In The Ai Era

The rise of AI creates new job opportunities. It also demands new skills. Key areas of focus include:

- Data analysis: Understanding data patterns is crucial.

- Machine learning: Knowledge of algorithms is in high demand.

- Cybersecurity: Protecting data becomes essential with more AI usage.

Training programs and certifications will help professionals transition into AI roles. Organizations must invest in upskilling their workforce. This ensures they remain relevant in the evolving job market.

Frequently Asked Questions

What Is The Role Of Artificial Intelligence In The Fintech Industry?

Artificial intelligence plays a crucial role in fintech by enhancing customer service, detecting fraud, predicting investments, and automating processes like credit scoring. It improves efficiency, personalizes experiences, and enables data-driven decision-making, transforming the financial landscape significantly. AI continues to drive innovation in the industry.

How Is Ai Transforming The Financial Sector?

AI transforms the financial sector by enhancing data analysis, automating processes, and improving fraud detection. It enables personalized customer experiences and predictive analytics. Financial institutions use AI for efficient credit scoring and investment strategies, ultimately driving innovation and operational efficiency.

What Is The Impact Of Artificial Intelligence On E Banking And Financial Technology Development?

Artificial intelligence transforms e-banking and fintech by enhancing customer service, improving fraud detection, and streamlining operations. It enables personalized experiences, boosts efficiency, and supports data-driven decision-making. Overall, AI drives innovation and competitiveness in the financial sector, reshaping how services are delivered.

How Ai Will Transform Financial Management?

AI will transform financial management by improving accuracy, enhancing strategic planning, and reducing costs. It automates processes, enabling CFOs to focus on strategy. This shift allows finance leaders to become essential partners in their organizations, driving overall business performance and fostering innovation.

Conclusion

Artificial intelligence is revolutionizing the fintech sector, making financial services more efficient and accessible. By enhancing customer experiences and improving risk management, AI is paving the way for innovation. As technology evolves, its impact on finance will only grow. Embracing AI is essential for staying competitive in this dynamic landscape.