Fintech is revolutionizing payments by offering faster, more secure transaction methods. This transformation enhances user experience and breaks down traditional financial barriers.

The future of payments is rapidly evolving, driven by fintech innovations. Consumers now prefer seamless, digital transactions over cash or traditional banking methods. Technologies like mobile wallets, cryptocurrency, and biometric authentication are at the forefront of this shift. These advancements not only streamline payment processes but also enhance security, reducing fraud risks.

The rise of open banking and real-time payment systems is reshaping financial interactions, making them more user-friendly. As businesses adapt to these changes, understanding the impact of fintech on payment methods becomes essential for both consumers and companies. Embracing these innovations will define the future of commerce and financial services.

Credit: corporate.payu.com

The Rise Of Fintech

The rise of fintech is transforming how we handle payments. This shift is making transactions faster, easier, and more secure. Fintech companies are challenging traditional banks. They offer innovative solutions that meet modern needs.

A Brief History

Fintech has roots tracing back to the late 20th century. Here’s a quick timeline of its evolution:

| Year | Milestone |

|---|---|

| 1950s | First credit cards introduced. |

| 1990s | Online banking emerges. |

| 2000s | Mobile banking gains popularity. |

| 2010s | Rise of peer-to-peer lending. |

| 2020s | Digital currencies become mainstream. |

Key Drivers Behind The Fintech Revolution

Several factors fuel the fintech revolution:

- Technology Advancements: New technologies make transactions easier.

- Consumer Demand: People want faster and simpler payment options.

- Regulatory Changes: Governments encourage innovation in financial services.

- Globalization: Businesses seek solutions that work worldwide.

- Data Analytics: Companies use data to improve services.

These drivers create a vibrant fintech landscape. Businesses and consumers benefit from these innovations. The future of payments looks bright with fintech leading the way.

Demystifying Modern Payment Technologies

Modern payment technologies are transforming the way we handle transactions. They simplify processes and enhance security. Fintech innovations break down barriers in traditional banking. Understanding these technologies helps users adapt to changes.

From Plastic To Digital: The Evolution Of Payment Methods

The shift from plastic cards to digital payments is remarkable. Here’s a brief look at how payment methods have evolved:

| Era | Payment Method | Characteristics |

|---|---|---|

| Past | Cash | Physical currency, limited to face-to-face transactions |

| 1980s | Plastic Cards | Convenient, but required physical presence to use |

| 2000s | Online Payments | Introduced e-commerce, but often required credit card details |

| Today | Mobile Wallets | Fast, secure, and accessible anywhere with a smartphone |

Each evolution makes payments easier and faster. Users now prefer digital solutions for their convenience.

Biometric Authentication: A Game Changer

Biometric authentication is revolutionizing payment security. It uses unique physical traits for identification. Common methods include:

- Fingerprint Scanning: Quick and reliable.

- Facial Recognition: Fast and contactless.

- Iris Scanning: Highly secure and accurate.

These technologies reduce fraud risk. They also speed up transactions, making payments seamless.

Users no longer need to remember complex passwords. Biometric authentication offers a safer, simpler way to pay.

The Surge In Mobile And Digital Wallets

The rise of mobile and digital wallets marks a significant shift in how we handle money. These wallets allow users to store their card information and make payments using their smartphones. With just a few taps, payments become quick and seamless. This convenience is transforming our everyday transactions.

How Smartphones Are Becoming The New Wallets

Smartphones are evolving into essential payment tools. Users can now pay for goods and services without cash or cards. Here are some key features of mobile wallets:

- Convenience: Carry all cards in one app.

- Speed: Complete transactions in seconds.

- Accessibility: Available anytime, anywhere.

Popular mobile wallets include:

| Wallet Name | Key Features |

|---|---|

| Apple Pay | Easy integration with Apple devices. |

| Google Pay | Supports various payment methods and loyalty cards. |

| PayPal | Wide acceptance online and in stores. |

Security Measures For Mobile Payments

Security is crucial in mobile payments. Users want to know their information is safe. Here are common security measures:

- Encryption: Protects data during transactions.

- Biometric authentication: Uses fingerprints or facial recognition.

- Two-factor authentication: Adds an extra layer of security.

These measures help build trust. As users feel secure, they embrace mobile wallets more. The future of payments looks bright with these innovations.

Blockchain And Cryptocurrency In Payments

Blockchain and cryptocurrency are revolutionizing payment methods. They bring speed, security, and transparency to transactions. Understanding these technologies is crucial for grasping the future of payments.

Decentralizing Transactions: An Overview

Blockchain technology allows for decentralized transactions. This means no central authority controls the process. Here are some key benefits:

- Reduced Costs: Lower transaction fees without intermediaries.

- Increased Security: Transactions are encrypted and immutable.

- Faster Settlements: Transactions occur almost instantly.

Centralized systems can be slow and vulnerable. Blockchain provides a solution. It enables peer-to-peer transactions without delays.

Crypto Wallets And Their Impact

Crypto wallets are essential for handling digital currencies. They store, send, and receive cryptocurrencies securely. Here are the main types:

| Type of Wallet | Description |

|---|---|

| Hot Wallet | Connected to the internet. Easy access but less secure. |

| Cold Wallet | Offline storage. More secure but less convenient. |

Crypto wallets impact payment methods significantly:

- Accessibility: Anyone can create a wallet.

- Control: Users manage their funds directly.

- Privacy: Transactions can remain anonymous.

These features make cryptocurrencies appealing. They challenge traditional banking systems. Financial freedom and inclusivity are on the rise.

The Role Of Ai And Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming payments. They enhance security, personalize experiences, and automate processes. These technologies make transactions faster and safer for everyone.

Automating Fraud Detection

Fraud detection is crucial in payments. AI and ML can analyze patterns quickly. They help identify unusual activity in real-time.

- Real-time monitoring detects fraud instantly.

- Data analysis improves accuracy over time.

- Adaptive learning helps systems evolve with new threats.

For example, AI can flag transactions that deviate from user habits. This keeps accounts safer and reduces losses.

Personalizing The Payment Experience

Personalization improves customer satisfaction. AI helps tailor payment options based on user behavior.

| Personalization Strategies | Benefits |

|---|---|

| Customized Offers | Increased engagement and loyalty. |

| Preferred Payment Methods | Faster checkouts and less frustration. |

| Transaction History Analysis | Better recommendations and user experience. |

Personalized experiences make payments easier. Customers appreciate options that meet their needs. This leads to greater satisfaction and more frequent transactions.

Credit: www.amazon.com

Regulatory Challenges And Opportunities

The rapid growth of fintech brings both challenges and opportunities in regulation. Governments aim to protect consumers while fostering innovation. Striking a balance is crucial for the industry’s future.

Navigating The Global Regulatory Landscape

Fintech operates in a complex global regulatory environment. Each country has its own rules. This creates challenges for fintech companies aiming for global reach.

- Compliance Costs: Meeting diverse regulations can be expensive.

- Market Entry: New regulations may hinder access to certain markets.

- Innovation vs. Regulation: Balancing innovation with compliance is tough.

Despite these challenges, opportunities exist:

- Standardization: Efforts for harmonized regulations can simplify compliance.

- Collaboration: Regulators and fintechs can work together to create better frameworks.

- Consumer Trust: Strong regulations can enhance consumer confidence.

Open Banking And Its Implications For Fintech

Open banking allows third-party access to financial data. This shifts power from banks to consumers. It encourages competition and innovation in the fintech space.

| Open Banking Benefits | Implications for Fintech |

|---|---|

| Improved Services: Personalized financial products emerge. | Increased Competition: More players enter the market. |

| Enhanced Security: Stronger data protection measures. | Innovation Boost: New solutions and services develop quickly. |

| Customer Control: Users have more choices. | Collaboration Opportunities: Partnerships with banks increase. |

Open banking presents both risks and rewards. Fintech companies must adapt to these changes. Success relies on navigating the regulatory landscape effectively.

Future Trends To Watch In The Payment Sector

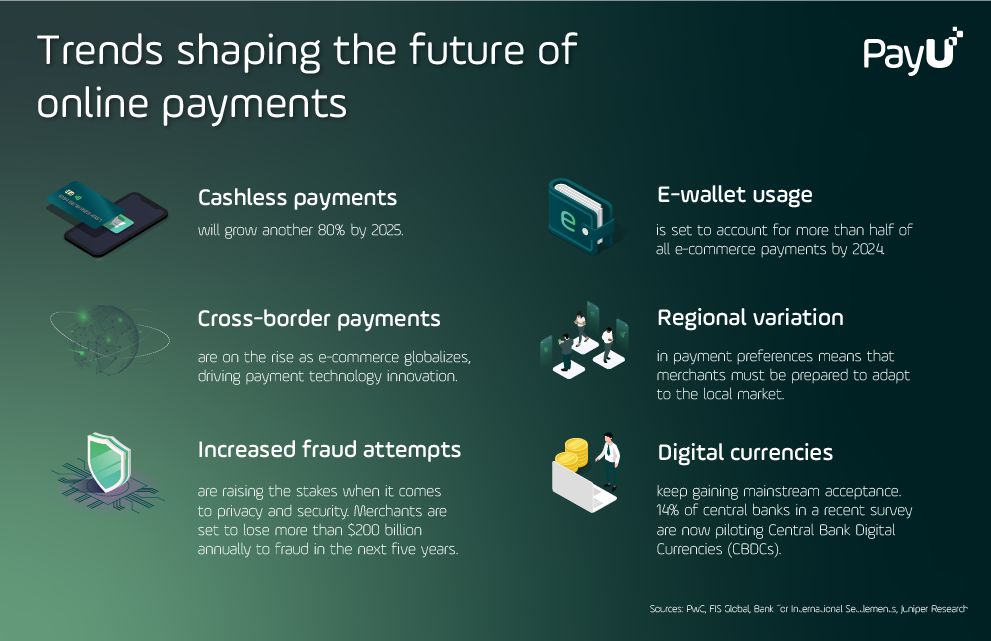

The payment sector is evolving rapidly. Fintech innovations are reshaping how we pay. Consumers demand faster, safer, and more convenient payment methods. Understanding upcoming trends can help you stay ahead.

The Potential Of Real-time Payments

Real-time payments are changing the landscape. These payments allow instant transactions. Money transfers happen in seconds, not hours or days. This shift enhances user experience significantly.

- Instant Transactions: Customers receive funds immediately.

- 24/7 Availability: Payments can be made at any time.

- Cost Efficiency: Reduced transaction fees for businesses.

Many banks and fintech firms are adopting real-time payment systems. This trend will likely grow in the coming years. Expect more businesses to offer these services.

The Rise Of ‘buy Now, Pay Later’ Services

‘Buy Now, Pay Later’ (BNPL) services are gaining popularity. They allow customers to purchase items and pay later in installments. This method appeals to younger consumers and those seeking budget flexibility.

| Benefits of BNPL | Considerations |

|---|---|

| Easy access to products | Potential for overspending |

| No interest if paid on time | Late fees can accumulate |

| Improved cash flow for consumers | Impact on credit score |

Many retailers are adopting BNPL options. This trend will continue to grow as consumer preferences shift. Expect to see more partnerships between retailers and fintech companies.

Credit: www.linkedin.com

The Global Impact Of Fintech On Payments

Fintech is reshaping payment systems globally. It boosts efficiency, security, and accessibility. Innovations in technology help people manage their money better. This transformation is evident in many areas of finance. It allows for faster transactions and new payment methods.

Fintech’s Role In Financial Inclusion

Fintech plays a crucial role in promoting financial inclusion. Many people worldwide lack access to banking services. Fintech solutions bridge this gap.

- Mobile Banking: Users can access accounts anytime, anywhere.

- Microloans: Small loans help entrepreneurs start businesses.

- Digital Wallets: Users can make payments without a bank account.

These tools empower individuals and small businesses. They also foster economic growth in underserved areas. Statistics show that fintech increases financial literacy and trust.

| Fintech Solutions | Benefits |

|---|---|

| Mobile Banking | Accessibility and convenience |

| Microloans | Support for local businesses |

| Digital Wallets | Cashless transactions |

The Future Of Cross-border Payments

Cross-border payments are evolving rapidly. Fintech simplifies transactions across borders. Traditional methods are often slow and costly.

- Blockchain Technology: Ensures transparency and security.

- Cryptocurrencies: Facilitate instant transactions.

- Peer-to-Peer Networks: Reduce fees and delays.

These innovations create a more connected world. They allow businesses to operate globally without barriers. As fintech grows, cross-border payments will become faster and cheaper.

Frequently Asked Questions

How Has Fintech Changed Payments?

FinTech has transformed payments by enabling instant transactions and enhancing security. Technologies like mobile wallets and biometric authentication streamline user experiences. Consumers benefit from faster, more transparent processes, while businesses enjoy reduced transaction costs. Overall, FinTech promotes a cashless, efficient payment ecosystem.

How Is Technology Changing The Way We Pay?

Technology is revolutionizing payments by enabling instant transactions, enhancing security with biometric authentication, and promoting cashless options like mobile wallets. These advancements offer consumers faster, more efficient, and user-friendly payment experiences, reshaping the financial landscape significantly.

What Is The Future Of Payment Technology?

The future of payment technology focuses on digital transformation. Expect increased use of mobile wallets, cryptocurrencies, and biometric authentication. Cashless transactions will dominate, offering speed and security. Open banking systems will enhance user experiences, making payments more seamless and efficient across various platforms.

What Is The Payment Solution Of Fintech?

FinTech payment solutions include services like credit and debit card processing, digital wallets, and bill payments. These innovations enhance transaction speed, security, and user convenience. They streamline financial services, making payments easier for consumers and businesses alike.

Conclusion

Fintech is reshaping the payments landscape, offering innovative solutions that enhance convenience and security. As digital wallets, cryptocurrencies, and biometric technologies gain traction, consumers will benefit from seamless transactions. Embracing these advancements will ensure a smoother payment experience, paving the way for a cashless society.

The future of payments looks bright and transformative.