Renters insurance protects your personal belongings from theft, fire, and other damages. It also provides liability coverage for accidents that occur in your rented space.

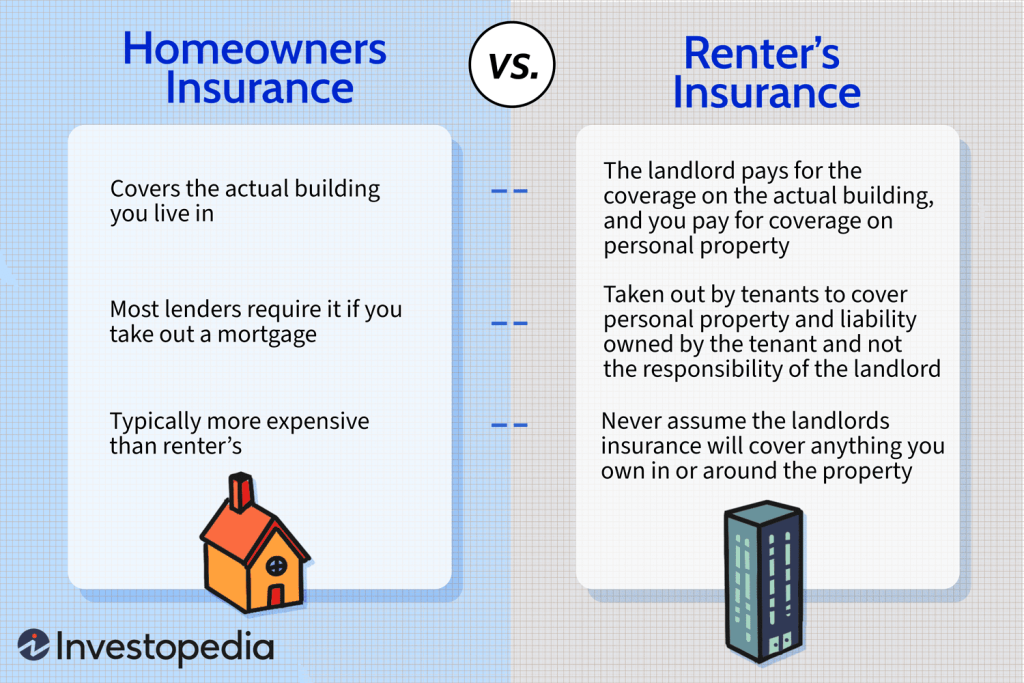

Renters insurance is essential for anyone living in a rental property. It safeguards your personal belongings, such as electronics, furniture, and clothing, against unforeseen events. Many people mistakenly believe that their landlord’s insurance covers their possessions. However, that coverage typically only protects the building itself.

Renters insurance also offers liability protection, covering medical expenses if someone is injured in your home. This affordable insurance provides peace of mind, ensuring you won’t face financial hardship due to unexpected incidents. Understanding renters insurance can help you make an informed decision about protecting your assets and securing your living space.

The Need For Renters Insurance

Renters insurance is vital for anyone renting a home. It protects personal belongings and provides liability coverage. Without it, renters face significant risks. Many people underestimate the importance of this insurance. Understanding its benefits can safeguard your finances.

Protecting Personal Property

Many renters own valuable items. These items include electronics, furniture, and clothing. Renters insurance can help replace stolen or damaged belongings. Here are key points about personal property protection:

- Covers loss from theft.

- Covers damage from fire or water.

- Protects items even outside the home.

Imagine losing your laptop or smartphone. The cost of replacement can be high. Renters insurance can ease this financial burden. Many policies offer coverage for up to $30,000 or more. This protection gives peace of mind.

Liability Coverage Benefits

Liability coverage is another critical aspect of renters insurance. It protects renters from lawsuits. Here’s how it works:

| Scenario | Potential Cost |

|---|---|

| Guest injury in your home | Up to $100,000 |

| Accidental damage to neighbor’s property | Up to $50,000 |

Liability coverage can cover legal fees too. It protects your assets in case of a claim. This coverage is often included in most policies. Having this safety net is essential.

Renters insurance is a smart choice. It safeguards belongings and offers liability protection. The peace of mind it brings is priceless. Don’t underestimate its importance in your life.

:max_bytes(150000):strip_icc()/Renters-insurance-4223009-final-a125edb41c2f4a4a980ef2cf069d7723.png)

Credit: www.investopedia.com

Myths Vs. Facts

Many people hold misconceptions about renters insurance. Understanding these myths helps you make informed decisions. Let’s break down some common myths and reveal the truths behind them.

Common Misconceptions

- Myth 1: Renters insurance is too expensive.

- Myth 2: My landlord’s insurance covers my belongings.

- Myth 3: Renters insurance only covers theft.

- Myth 4: It’s not necessary if I don’t have many items.

Truths Uncovered

| Myth | Fact |

|---|---|

| Renters insurance is too expensive. | Most policies cost less than $20 a month. |

| My landlord’s insurance covers my belongings. | Landlord insurance only protects the building, not your stuff. |

| Renters insurance only covers theft. | It covers fire, water damage, and more. |

| It’s not necessary if I don’t have many items. | Even small items can add up to a lot. |

Understanding these myths and facts empowers you. Protect your belongings with the right insurance. Don’t let common misconceptions hold you back.

Comparing Policies

Understanding different renters insurance policies is crucial. Each policy offers unique benefits and coverage options. This section highlights key aspects to consider.

Coverage Variations

Renters insurance policies vary widely. Here are common coverage types:

- Personal Property Coverage: Protects your belongings from theft or damage.

- Liability Coverage: Covers injuries to others on your property.

- Additional Living Expenses: Pays for temporary housing if your home is uninhabitable.

Look for policies that meet your needs. Some providers offer extra options like:

| Coverage Type | Description |

|---|---|

| Replacement Cost | Covers the cost to replace items without depreciation. |

| Actual Cash Value | Covers current value after depreciation. |

| Flood Insurance | Protects against water damage from floods. |

Reading The Fine Print

Carefully read the policy details. Key points include:

- Exclusions: Understand what is not covered.

- Limits: Know the maximum payout for claims.

- Deductibles: Check how much you pay before coverage kicks in.

Ask questions to clarify confusing terms. Ensure you know your rights. Understanding these details helps avoid surprises during claims.

Cost-saving Strategies

Saving money on renters insurance is possible. Many strategies can help you lower your premium. Here are two effective methods.

Bundling With Other Insurance

Bundling renters insurance with other policies can save money. Many providers offer discounts for combining policies.

- Homeowners insurance

- Auto insurance

- Life insurance

Check with your insurance company. They often provide special rates for bundled plans. This simple step can lead to significant savings.

Increasing Deductibles

Another way to reduce your premium is by increasing your deductible. A deductible is the amount you pay out of pocket before insurance kicks in.

| Deductible Amount | Monthly Premium |

|---|---|

| $250 | $30 |

| $500 | $25 |

| $1,000 | $20 |

Higher deductibles lead to lower monthly payments. Choose a deductible you can afford. This can help you save money over time.

Credit: nvestopedia.com

Discounts And Deals

Renters insurance can be affordable, especially with various discounts. Many companies offer ways to save on premiums. Understanding these discounts helps you choose the right policy.

Loyalty And No-claim Discounts

Many insurance providers reward loyal customers. Staying with the same company often leads to significant savings.

- Loyalty Discounts: Discounts for long-term customers.

- No-Claim Discounts: Savings for claim-free years.

These discounts can lead to reduced monthly payments. Always ask your insurer about available loyalty rewards.

Payment Plan Options

Flexible payment plans can ease financial stress. Many companies offer various options to fit your budget.

| Payment Plan Type | Description |

|---|---|

| Monthly Payments | Pay your premium in small monthly installments. |

| Quarterly Payments | Pay every three months. Often cheaper than monthly plans. |

| Annual Payment | Pay the full premium upfront. Often the most cost-effective option. |

Choose a payment plan that fits your budget. This makes renters insurance easier to manage.

Tenant’s Insurance And Roommates

Understanding tenant’s insurance is crucial for roommates. This type of insurance protects personal belongings. It also covers liability issues. Sharing a home means sharing risks. Knowing your options helps keep everyone safe.

Shared Policies

Roommates can choose shared tenant’s insurance policies. Here are some benefits:

- Lower premiums when shared.

- Coverage for everyone’s belongings.

- One point of contact for claims.

Before choosing a shared policy, consider the following:

| Factor | Details |

|---|---|

| Coverage Limits | Check if the total limit covers all roommates. |

| Personal Property | Ensure everyone’s items are included. |

| Deductibles | Understand the deductible for claims. |

Individual Coverage Considerations

Some roommates prefer individual tenant’s insurance policies. This option has its perks:

- Personalized coverage limits.

- Control over individual claims.

- Independent financial responsibility.

Each roommate should think about these points:

- Value of personal belongings.

- Potential liability risks.

- Budget for insurance costs.

Individual policies can provide peace of mind. They ensure each person feels secure in their space.

Navigating Claims

Understanding how to navigate claims is essential for renters. A claim can help you recover losses from theft, fire, or other damages. Knowing the process can save time and reduce stress.

Filing A Claim

Filing a claim is straightforward. Follow these steps:

- Contact Your Insurer: Call your insurance company.

- Gather Evidence: Collect photos and documents of the damage.

- Complete the Claim Form: Fill out the required forms accurately.

- Submit Your Claim: Send your claim to your insurer.

Remember to keep copies of everything. This helps track your claim’s progress.

Speeding Up The Process

Speeding up your claim can reduce waiting time. Here are some tips:

- Be Prompt: Report the incident as soon as possible.

- Stay Organized: Keep all paperwork in one place.

- Follow Up: Check in regularly with your insurer.

- Provide Detailed Information: Include all necessary details in your claim.

Using these strategies can help you receive your payout faster. Always communicate clearly with your insurance representative.

Renewal And Policy Update Tips

Understanding renewal and policy updates for renters insurance is crucial. Regular reviews help ensure you have the right coverage. Here are some tips to make the process easier.

When To Shop Around

Shopping around for renters insurance can save you money. Consider these key times to evaluate your options:

- Before your policy renewal date

- After a significant life change

- When your current premium increases

- When you hear about better coverage options

Compare quotes from different providers. This helps you find the best price and coverage. Keep an eye on customer reviews for a better understanding of service quality.

Updating Coverage As Needs Change

Your coverage needs may change over time. It’s essential to update your policy accordingly. Here are some factors that may require an update:

- New Purchases: Add high-value items like electronics or jewelry.

- Roommates: Include their belongings if they move in.

- Moving: Different locations may have different risks.

- Life Changes: Marriage or children may increase your coverage needs.

Review your policy at least once a year. This ensures you have the right protection. Document any valuable items and keep receipts for easy updates.

Resources And Tools

Finding the right renters insurance can be simple with the right resources. Various tools help you compare options and calculate coverage. Use these tools to make informed decisions.

Online Quote Comparisons

Online quote comparisons allow you to see multiple options quickly. These tools gather quotes from various insurers. This helps you find the best deal.

- Compare prices from different companies.

- Check coverage options side by side.

- Read customer reviews for each insurer.

Popular websites for online comparisons include:

| Website | Features |

|---|---|

| Policygenius | Easy to use, many quotes |

| Insure.com | Comprehensive comparisons, expert advice |

| CoverHound | Quick quotes, user-friendly interface |

Insurance Calculators

Insurance calculators help you determine how much coverage you need. They consider your belongings and personal needs.

- Input the value of your personal items.

- Adjust for additional coverage like liability.

- Get a recommended coverage amount.

Using these calculators can save you money. They ensure you do not overpay for coverage. Popular tools include:

- State Farm’s coverage calculator

- Allstate’s personal property calculator

- Geico’s renters insurance estimator

Expert Insights

Understanding renters insurance can be tricky. Hearing from professionals and real renters helps clarify its importance. This section includes insights from insurance agents and experiences from actual renters.

Interviews With Insurance Agents

We spoke to several insurance agents to gather their thoughts. Here are some key takeaways:

- Coverage Variety: Renters insurance covers personal belongings, liability, and additional living expenses.

- Affordability: Most policies cost between $15 to $30 per month.

- Importance: Many renters underestimate the risks of not having coverage.

- Claims Process: Quick and straightforward claims can save renters stress.

Agents recommend reviewing your policy annually. Changes in belongings or lifestyle can affect coverage needs.

Real Renter Experiences

Real-life stories illustrate the value of renters insurance. Here are a few examples:

| Renter | Incident | Outcome |

|---|---|---|

| Sarah | Fire damage | Replaced furniture and clothes |

| Mike | Theft | Claim covered stolen electronics |

| Lily | Water damage | Received funds for repairs |

Each renter faced a different challenge. They all agreed on one thing: renters insurance made a huge difference.

- Sarah felt secure knowing her belongings were protected.

- Mike was relieved his policy covered his expensive laptop.

- Lily appreciated the financial help for her repairs.

These stories highlight the peace of mind that comes with renters insurance. Protecting personal belongings is essential for every renter.

Credit: www.thejosephgroup.com

Frequently Asked Questions

What Is Renters Insurance?

Renters insurance is a type of coverage that protects your personal belongings in a rented space. It typically covers theft, fire, and water damage. Additionally, it provides liability protection in case someone gets injured in your rental. This insurance ensures peace of mind for tenants.

Why Do I Need Renters Insurance?

Renters insurance is essential for safeguarding your possessions. Without it, you risk losing valuable items due to unforeseen events like fire or theft. It also helps with liability costs if someone is injured in your home. Ultimately, it offers financial protection and security for renters.

How Much Does Renters Insurance Cost?

The average cost of renters insurance ranges from $15 to $30 per month. Factors influencing the price include location, coverage limits, and personal belongings’ value. Many providers offer discounts for bundling policies. It’s wise to compare quotes to find affordable coverage that meets your needs.

What Does Renters Insurance Cover?

Renters insurance typically covers personal property, liability, and additional living expenses. It protects belongings from risks like theft, fire, and vandalism. Liability coverage helps with legal fees if someone is injured on your property. Always review your policy for specific coverage details.

Conclusion

Renters insurance offers essential protection for your belongings. It safeguards against theft, fire, and unexpected events. Securing a policy can provide peace of mind while renting. Don’t underestimate its value. Taking this step helps ensure your possessions are covered, making your living experience worry-free.

Protect what matters most today.