The future of loans will see increased digitization and personalized lending experiences. Innovations like AI and blockchain will reshape how consumers access credit.

As we approach 2025, the lending landscape is poised for transformation. Advances in technology are driving significant changes in how loans are processed and delivered. Digital platforms are emerging as the preferred choice for borrowers seeking speed and convenience. Personalized lending solutions, powered by data analytics, will enable lenders to offer tailored options.

Additionally, the rise of alternative credit scoring methods is changing the evaluation process, making loans accessible to a broader audience. Understanding these trends will help consumers and businesses navigate the evolving financial landscape and optimize their borrowing strategies for the future.

The Evolution Of Lending

The lending landscape is changing rapidly. New trends are shaping how consumers borrow money. Technology plays a significant role in this evolution. Understanding these changes can help borrowers make informed decisions.

Shifts In Borrowing Habits

Borrowing habits are shifting due to various factors:

- Digital Natives: Younger generations prefer online platforms.

- Instant Gratification: Consumers want quick access to funds.

- Financial Awareness: People are more informed about loan options.

These shifts lead to new expectations from lenders:

- Faster approval processes.

- Transparent terms and conditions.

- Customized loan products.

Borrowers now seek personalized experiences. They value convenience and speed. Lenders must adapt to these evolving demands.

Advancements In Financial Technology

Financial technology is revolutionizing the lending process:

| Technology | Impact on Lending |

|---|---|

| AI and Machine Learning | Enhances credit scoring and risk assessment. |

| Blockchain | Improves security and transparency in transactions. |

| Mobile Apps | Facilitates easy access to loans anytime, anywhere. |

These technologies streamline the application process. They also reduce costs for both lenders and borrowers. Enhanced security measures build trust in the lending system.

As technology advances, lending will become more efficient. Borrowers will benefit from lower rates and better service.

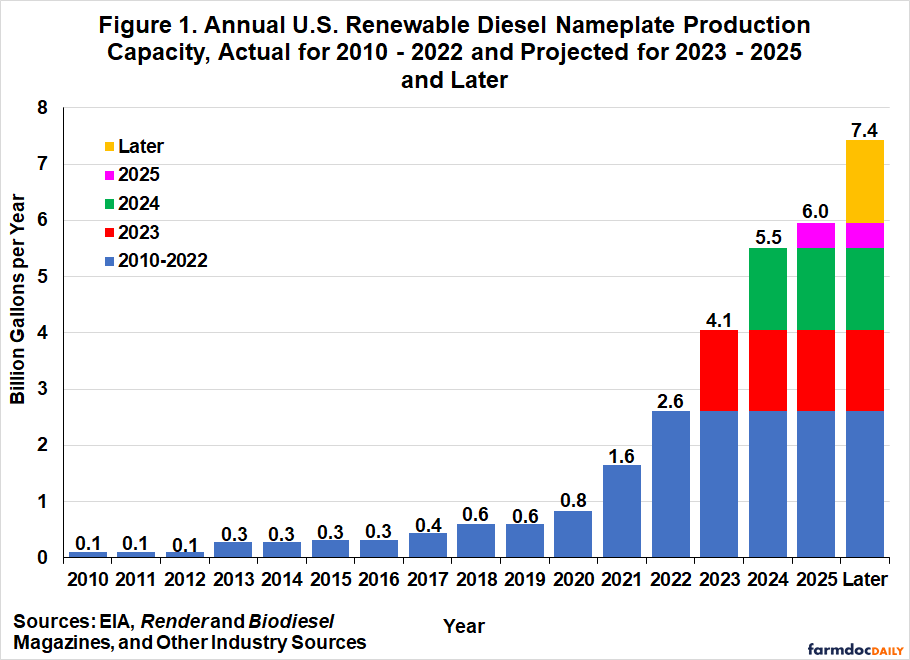

Credit: farmdocdaily.illinois.edu

Innovations In Loan Products

The loan industry is evolving rapidly. New products are emerging. These innovations aim to meet diverse consumer needs. Let’s explore some exciting trends shaping the future of loans.

Rise Of Personalized Lending

Personalized lending is gaining momentum. Consumers want loans tailored to their unique situations. Financial institutions are leveraging data analytics. They analyze customer behavior and preferences.

- Customized Offers: Lenders create unique loan packages.

- Flexible Terms: Borrowers can choose terms that fit their budgets.

- Dynamic Interest Rates: Rates adjust based on personal financial health.

This approach fosters trust and loyalty. Customers feel valued. They are more likely to return for future loans. Personalized lending will dominate the market by 2025.

Green Loans And Sustainability

Sustainability is a hot topic today. Green loans support eco-friendly projects. These loans encourage environmentally responsible choices. They promote energy-efficient homes and renewable energy.

| Type of Green Loan | Purpose | Benefits |

|---|---|---|

| Energy-Efficient Mortgages | Home improvements for energy savings | Lower utility bills, increased home value |

| Solar Panel Financing | Install solar panels on homes | Tax credits, long-term savings |

| Green Business Loans | Funding for eco-friendly businesses | Support sustainable practices, attract eco-conscious customers |

Green loans are more than just financial products. They represent a shift towards sustainable living. Consumers are increasingly choosing eco-friendly options. This trend will continue to grow into 2025 and beyond.

Impact Of Artificial Intelligence

Artificial Intelligence (AI) is transforming the loan industry. It enhances efficiency and accuracy. With AI, lenders can assess risks and manage loans better than ever. As we move towards 2025, AI’s role will only grow.

Ai In Risk Assessment

AI improves risk assessment in loans significantly. Traditional methods often rely on outdated data. AI analyzes vast amounts of data quickly. This leads to better decision-making.

- Predictive Analytics: AI uses algorithms to predict borrower behavior.

- Data Sources: It considers non-traditional data like social media activity.

- Real-Time Analysis: AI evaluates risk in real-time, ensuring timely decisions.

These features make lending safer. Lenders can identify high-risk borrowers effectively. This reduces defaults and enhances profitability.

Automated Loan Management Systems

Automated loan management systems streamline processes. They reduce human error and speed up approvals. AI can handle routine tasks like document verification.

| Benefits of Automated Systems | Impact |

|---|---|

| Increased Efficiency | Faster processing times for loans |

| Cost Reduction | Lower operational costs for lenders |

| Enhanced Customer Experience | Quicker responses and approvals for borrowers |

These systems can also personalize loan offerings. They analyze user data to tailor products. This helps meet customer needs effectively.

The future of loans will heavily rely on AI. It will shape how lenders operate and interact with borrowers.

Changing Regulations And Compliance

The landscape of loans is shifting rapidly. Changing regulations and compliance requirements are reshaping how lenders operate. By 2025, these changes will impact everything from application processes to interest rates. Understanding these trends helps borrowers and lenders prepare for the future.

Global Regulatory Trends

Regulations around the world are becoming stricter. Governments aim to protect consumers and maintain economic stability. Here are some key global regulatory trends:

- Increased Transparency: Lenders must disclose more information.

- Stricter Credit Assessments: Lenders will analyze borrowers’ creditworthiness more carefully.

- Consumer Protection Laws: These laws will be enforced to prevent predatory lending.

- Digital Compliance Standards: Regulations will target online lending practices.

Countries are working together to create a cohesive framework. This will help manage risks across borders. Financial institutions need to stay updated on these developments.

Adapting To New Loan Legislations

Lenders must adapt quickly to new loan legislations. Compliance will require significant changes in operations. Here are some important steps lenders can take:

- Training Staff: Educate employees about new regulations.

- Updating Technology: Invest in software to ensure compliance.

- Reviewing Policies: Regularly update lending practices to align with laws.

- Monitoring Changes: Keep an eye on upcoming regulatory changes.

Failure to comply can result in hefty fines. Lenders must prioritize compliance to avoid risks. The future of loans will depend on how well institutions adapt to these evolving regulations.

The Role Of Cryptocurrencies

Cryptocurrencies are reshaping the lending landscape. Digital currencies provide new opportunities for borrowers and lenders alike. They promise faster transactions, lower fees, and increased accessibility. Understanding their role is essential for predicting future loan trends.

Crypto-backed Lending

Crypto-backed lending is gaining popularity. This method allows users to borrow money using their cryptocurrencies as collateral. Here are some key benefits:

- Quick Access: Loans can be approved almost instantly.

- Lower Interest Rates: Rates are often lower than traditional loans.

- No Credit Checks: Borrowers don’t need a credit history.

Many platforms facilitate crypto-backed loans. Users deposit their crypto assets and receive loans in fiat currency. This process opens doors for many who may not qualify for traditional loans.

Regulatory Challenges With Digital Assets

Despite the benefits, regulatory challenges exist. Governments are still figuring out how to regulate cryptocurrencies. Here are some common issues:

- Legal Status: Different countries have different laws.

- Consumer Protection: Regulations must protect borrowers.

- Tax Implications: Tax treatment of crypto transactions is unclear.

These challenges can slow down the growth of crypto-backed lending. However, as regulations become clearer, more users may adopt this lending model. The future of loans will likely see cryptocurrencies play a significant role.

Peer-to-peer Lending Expansion

Peer-to-peer (P2P) lending is rapidly changing the borrowing landscape. This innovative model connects borrowers directly with lenders. It cuts out traditional banks and financial institutions. The P2P lending market is set to grow significantly by 2025. More people will use these platforms to secure loans.

Growth Of Decentralized Finance

Decentralized finance (DeFi) is reshaping how we view loans. P2P lending is a vital part of this movement. It allows individuals to lend and borrow without intermediaries.

- Increased Accessibility: More people can access loans.

- Global Reach: Borrowers and lenders can connect worldwide.

- Lower Fees: Reduced costs for borrowers and lenders.

By 2025, P2P platforms will likely integrate advanced technology. Features such as blockchain will enhance security and transparency. Users can expect faster loan approvals and better user experiences.

Benefits And Risks Of P2p Platforms

P2P lending offers notable benefits and risks. Understanding these is crucial for users.

| Benefits | Risks |

|---|---|

| Lower interest rates for borrowers. | Risk of default by borrowers. |

| Flexible loan amounts. | Lack of regulation compared to banks. |

| Quick funding processes. | Potential for fraud and scams. |

Users should research platforms before participating. Reading reviews and checking ratings can help. Understanding terms and conditions is essential. Knowledge of these factors will lead to better decisions in the P2P lending space.

Consumer Behavior And Expectations

Consumer behavior is changing fast in the loan market. People want more from their lenders. Expectations are higher than ever. Let’s explore the trends shaping the future of loans.

Demand For Faster Loan Approvals

Today’s consumers expect quick results. They want faster loan approvals. Traditional processes feel slow and frustrating. Instant gratification drives this demand.

- Many borrowers seek loans online.

- Mobile applications simplify the process.

- Artificial intelligence speeds up approvals.

Financial institutions must adapt. They should streamline their processes. This can lead to:

- Increased customer satisfaction

- Higher loan conversion rates

- Enhanced brand loyalty

Customer Service In The Digital Age

Customer service is evolving with technology. Consumers expect quick responses and solutions. They prefer communication through digital channels.

| Channel | Consumer Preference |

|---|---|

| Chatbots | High |

| Medium | |

| Phone Calls | Low |

Lenders must focus on improving customer interactions. Key aspects include:

- 24/7 availability

- Personalized experiences

- Quick resolution of issues

Technology plays a vital role in shaping customer expectations. Companies that prioritize digital customer service will thrive.

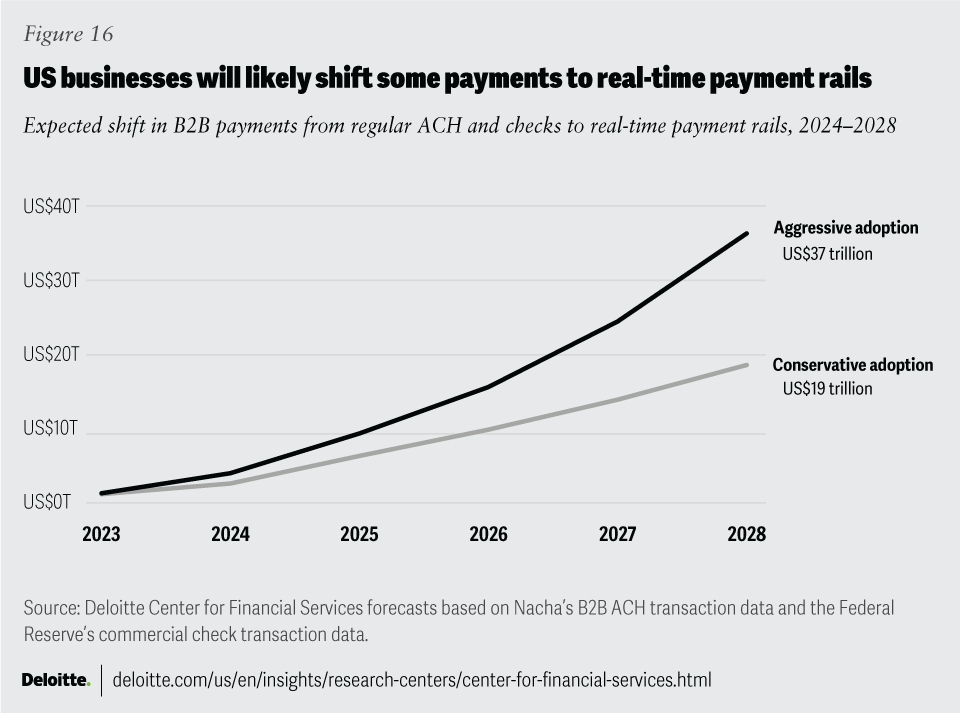

Credit: www2.deloitte.com

Forecasting The Mortgage Market

The mortgage market is changing rapidly. Understanding these changes helps consumers and lenders. This section explores key factors influencing the mortgage landscape in 2025 and beyond.

Interest Rate Predictions

Interest rates play a crucial role in mortgage affordability. Predictions for interest rates can guide buyers and investors. Here are some anticipated trends:

- Gradual Increase: Many experts predict a slow rise in rates.

- Volatility: Market conditions may cause fluctuations in rates.

- Inflation Impact: Continued inflation can drive rates higher.

Consider the following table that summarizes interest rate predictions:

| Year | Predicted Rate (%) |

|---|---|

| 2023 | 6.5% |

| 2024 | 6.8% |

| 2025 | 7.0% |

These predictions help potential homebuyers plan their purchases. Rising rates could mean higher monthly payments. Buyers should act quickly to secure favorable terms.

Housing Market Trends

The housing market is also evolving. Several trends are expected to shape it in the coming years:

- Increased Demand: Millennials are entering the housing market.

- Urban vs. Suburban: Suburban areas may see more interest.

- Remote Work: Flexible jobs may change where people live.

Forecasts suggest the following key points:

- Home Prices: Prices may stabilize but remain high.

- Inventory Levels: Low inventory could continue to drive prices up.

- Technology Integration: Digital tools will streamline the buying process.

Understanding these trends helps buyers make informed decisions. A solid grasp of the mortgage landscape can lead to better financial outcomes.

Preparing For The Future

As the loan landscape evolves, financial institutions must adapt. Emerging trends will shape how loans are offered. Understanding these changes is crucial for success. Let’s explore effective strategies and technologies that can prepare lenders for the future.

Strategies For Financial Institutions

Financial institutions need to implement specific strategies to stay competitive. Here are key approaches:

- Enhance Customer Experience: Focus on user-friendly services.

- Data Analytics: Use data to understand borrower needs.

- Risk Management: Adopt advanced risk assessment tools.

- Regulatory Compliance: Stay updated with changing regulations.

Implementing these strategies can improve efficiency and customer satisfaction. Here’s a quick look at why these strategies are essential:

| Strategy | Benefit |

|---|---|

| Enhance Customer Experience | Builds loyalty and trust. |

| Data Analytics | Informs better decision-making. |

| Risk Management | Minimizes financial loss. |

| Regulatory Compliance | Avoids legal issues. |

Investing In Loan Technologies

Investing in the right loan technologies is vital. Technology can streamline processes and enhance security. Consider these options:

- Automated Underwriting: Speeds up loan approvals.

- Blockchain: Increases transaction security.

- Artificial Intelligence: Improves customer service with chatbots.

- Mobile Applications: Facilitates on-the-go access for borrowers.

These technologies will transform the lending experience. They will also provide a competitive edge. Understanding and adopting these innovations is essential for future success.

Frequently Asked Questions

What Are Interest Rates Predicted To Be In 2025?

Interest rates in 2025 are expected to vary based on economic conditions. Analysts predict they may remain steady or rise slightly. Factors like inflation and monetary policy will influence these rates. Always consult financial experts for the most accurate predictions.

Will Mortgage Rates Go Down In The Next 5 Years?

Predicting mortgage rates over the next five years is challenging. Economic conditions, inflation, and government policies will all play significant roles. Experts suggest rates may fluctuate, but a consistent downward trend is uncertain. Stay informed to make the best financial decisions.

What Is The Future Of Fintech 2025?

The future of fintech in 2025 focuses on enhanced AI integration, increased regulatory compliance, and improved user experiences. Blockchain technology will gain traction, enabling secure transactions. Digital currencies will reshape payment systems, while personalized financial services will thrive, catering to individual consumer needs.

Will Loan Rates Go Down In 2024?

Predicting loan rates for 2024 remains uncertain. Economic factors, inflation, and Federal Reserve decisions will significantly influence rates. Stay updated on market trends to make informed decisions regarding loans.

Conclusion

The landscape of loans is rapidly evolving. Emerging technologies and shifting consumer preferences will redefine borrowing experiences. As we approach 2025, staying informed about these trends is essential. Embracing innovation will empower both lenders and borrowers. Prepare now to navigate this transformative financial future with confidence and clarity.