Online loans offer convenience and quick access to funds but can come with higher interest rates and fees. Borrowers must weigh these benefits against potential risks before making a decision.

In today’s fast-paced world, online loans have become a popular option for those in need of immediate cash. The ease of applying from home and receiving funds quickly attracts many borrowers. Traditional banks often involve lengthy processes that can delay access to money.

Online lenders streamline this experience, allowing for faster approvals. However, while online loans provide quick solutions, they may carry hidden costs and higher interest rates. Understanding the pros and cons of online loans is crucial for making informed financial decisions. This blog explores these aspects to help you navigate the world of online borrowing effectively.

The Rise Of Online Lending

Online lending has changed how people borrow money. Traditional banks have faced competition from digital lenders. Many prefer the speed and convenience of online loans. This shift has transformed personal finance for millions.

From Traditional Banks To Internet Financing

Traditional banks used to be the main option for loans. Now, many online platforms offer easy access to funds. Here are some key differences:

| Feature | Traditional Banks | Online Lenders |

|---|---|---|

| Application Process | Long and complex | Quick and simple |

| Approval Time | Days to weeks | Minutes to hours |

| Interest Rates | Varies widely | Often competitive |

| Accessibility | Limited hours | 24/7 access |

People can now compare options easily. Online reviews help borrowers make informed choices. Many lenders offer personalized rates based on credit scores.

The Digital Transformation Of Personal Finance

The digital world has reshaped personal finance. Borrowers can now manage loans through apps. This makes tracking payments easier.

- Instant approval notifications

- Automated payment reminders

- Access to loan history

Online lenders often provide educational resources. These resources help borrowers understand their options. Knowledge empowers consumers to make wise decisions.

Online lending is growing rapidly. Many people now rely on it for personal loans, student loans, and small business financing. The future of finance is digital and accessible for everyone.

Benefits Of Online Loans

Online loans offer many advantages. They provide quick access to funds. Understanding these benefits helps borrowers make informed choices.

Convenience And Speed

Online loans are easy to apply for. You can complete the process at home. Here are some key points:

- Applications are available 24/7.

- No need to visit a bank.

- Fast approval times.

- Funds can be deposited directly into your account.

These features save time and effort. You can focus on your needs, not the process.

Variety Of Options

Online lenders offer diverse loan types. Borrowers can choose what fits best. Here’s a breakdown:

| Loan Type | Description |

|---|---|

| Personal Loans | Used for any personal expense. |

| Business Loans | For business-related costs. |

| Student Loans | To cover education expenses. |

| Home Loans | For purchasing or refinancing a home. |

Borrowers can compare rates and terms easily. Finding the right fit is simpler.

Less Stringent Requirements

Online loans often have fewer requirements. Many lenders focus on credit scores. Here are some common criteria:

- Lower credit score needed.

- Proof of income may not be strict.

- Fast identity verification processes.

These relaxed standards help more people qualify. Getting approved can be easier than traditional loans.

Comparing Interest Rates

Understanding interest rates is crucial for online loans. They can significantly impact your total repayment. Comparing rates helps you find the best deal. Let’s explore how online and offline lending rates stack up.

Online Vs. Offline Lending Rates

Interest rates differ between online and offline lenders. Online lenders often provide lower rates. They save on overhead costs. Here’s a quick comparison:

| Lender Type | Average Interest Rate | Loan Processing Time |

|---|---|---|

| Online Lenders | 5% – 35% | 1-3 Days |

| Offline Lenders | 10% – 40% | 1-2 Weeks |

Online lenders often have lower average rates. They also process loans faster. This can be a big advantage in emergencies.

Hidden Costs To Watch Out For

Some online loans come with hidden costs. Always read the fine print. Here are common hidden fees:

- Origination Fees: Charged for processing your loan.

- Late Payment Fees: Applied if you miss a payment.

- Prepayment Penalties: Fees for paying off the loan early.

These fees can raise your overall cost. Always calculate the total amount before signing.

Understanding Credit Checks

Credit checks play a vital role in online loans. They help lenders assess your creditworthiness. Knowing how these checks work is essential.

Soft Vs. Hard Inquiries

Credit inquiries fall into two categories: soft and hard.

- Soft Inquiries: These do not affect your credit score.

- Hard Inquiries: These may lower your score by a few points.

Here’s a quick comparison:

| Type of Inquiry | Effect on Credit Score | Common Uses |

|---|---|---|

| Soft Inquiry | No impact | Pre-approval checks, personal credit reports |

| Hard Inquiry | May lower score | Loan applications, credit card applications |

Impact On Credit Score

Hard inquiries can affect your credit score. A lower score may limit loan options.

- Each hard inquiry may reduce your score by 5 points.

- Multiple inquiries in a short time can have a bigger impact.

- Soft inquiries help you check your score without penalties.

Maintain a good credit score by limiting hard inquiries.

Check your score regularly. Understanding your credit health is essential.

The Pitfalls Of Online Borrowing

Online borrowing offers quick access to funds. Yet, it comes with dangers. Understanding these pitfalls helps borrowers make informed choices.

Risk Of Overborrowing

Many people find online loans easy to obtain. This convenience can lead to overspending. Borrowers might take out more than they need.

- Instant approval may tempt quick decisions.

- High-interest rates can increase total debt.

- Multiple loans can create a cycle of debt.

Keep track of your finances. Create a budget to avoid borrowing too much.

Cybersecurity Concerns

Online lending exposes personal data to risks. Cybersecurity threats are a major concern.

- Hackers target financial information.

- Phishing scams trick users into sharing details.

- Data breaches can lead to identity theft.

Use secure websites. Look for HTTPS in the URL. Always protect your passwords.

Regulatory Grey Areas

Online loans may lack clear regulations. This can lead to unfair practices.

| Issue | Description |

|---|---|

| High-interest rates | Some lenders charge excessive fees. |

| Lack of transparency | Terms and conditions may be unclear. |

| Limited recourse | Borrowers may have few options for complaints. |

Research lenders carefully. Ensure they follow legal guidelines.

Smart Borrowing Strategies

Online loans can be a quick solution for financial needs. Smart borrowing strategies help you make informed decisions. They ensure you manage loans wisely and avoid pitfalls.

Assessing Your Financial Health

Understanding your financial health is crucial. Start by reviewing your income and expenses. Ask yourself these questions:

- What are my monthly expenses?

- How much do I earn each month?

- Do I have any existing debts?

Calculate your debt-to-income ratio. This ratio shows how much of your income goes to debt payments. A ratio below 36% is generally considered healthy.

Choosing The Right Lender

Not all lenders are the same. Choosing the right one can save you money. Compare different lenders using these criteria:

| Criteria | What to Look For |

|---|---|

| Interest Rates | Lower rates save you money. |

| Fees | Look for hidden fees. |

| Customer Reviews | Check online ratings and testimonials. |

| Repayment Terms | Flexible terms help manage payments. |

Read reviews and ask for recommendations. A trustworthy lender offers clear terms and good customer service.

Reading The Fine Print

Never skip the fine print. It contains essential details about your loan. Pay attention to:

- Interest rate specifics

- Fees and charges

- Repayment schedule

Look for any penalties for late payments. Understand your obligations before signing.

Taking time to read carefully can prevent future surprises. Make sure you fully understand the terms.

Customer Support And Services

Customer support is vital for online loans. Good support helps borrowers feel secure. It can make a big difference in the borrowing experience. Let’s explore the pros and cons of customer support in online loans.

Accessibility Of Assistance

Online loan services offer various ways to access help. Here are some common options:

- Live chat support

- Email assistance

- Phone support

- FAQ sections

Accessibility is a major benefit of online loans. Most services are available 24/7. Borrowers can reach out anytime. Quick responses can ease concerns. But, wait times can vary widely. Some services are faster than others. Always check reviews to find reliable support.

Resolving Disputes

Disputes can arise during the loan process. Strong customer support helps solve these issues. Here are some ways they assist:

- Direct contact with a representative

- Clear guidelines for filing complaints

- Follow-up on dispute status

Effective dispute resolution builds trust. It shows that the lender values customers. Poor support can lead to frustration. Disputes may linger without proper help. Choose lenders with a solid reputation for handling issues.

| Support Type | Pros | Cons |

|---|---|---|

| Live Chat | Instant responses | May lack detailed answers |

| Convenient | Slower response times | |

| Phone Support | Personal touch | Long wait times |

Looking To The Future

The future of online loans is bright. Technological advancements and regulations shape this landscape. Borrowers enjoy more options and better safety. Understanding these changes helps consumers make informed choices.

Technological Advances In Lending

Technology drives many changes in online lending. Here are key advancements:

- Artificial Intelligence: AI helps assess credit risk quickly.

- Blockchain: This technology secures transactions and enhances trust.

- Mobile Applications: Users can apply for loans on their phones.

- Data Analytics: Lenders analyze data for better loan offers.

These innovations make loans faster and easier. They also improve customer experiences.

Regulations And Consumer Protection

Regulations protect borrowers in the online loan market. They ensure fair practices and transparency. Key regulations include:

| Regulation | Description |

|---|---|

| Truth in Lending Act | Requires clear disclosure of loan terms and costs. |

| Equal Credit Opportunity Act | Prevents discrimination in lending. |

| Fair Debt Collection Practices Act | Regulates debt collection practices to protect consumers. |

These laws create a safer borrowing environment. Consumers can trust online lenders more. Awareness of these protections is essential for all borrowers.

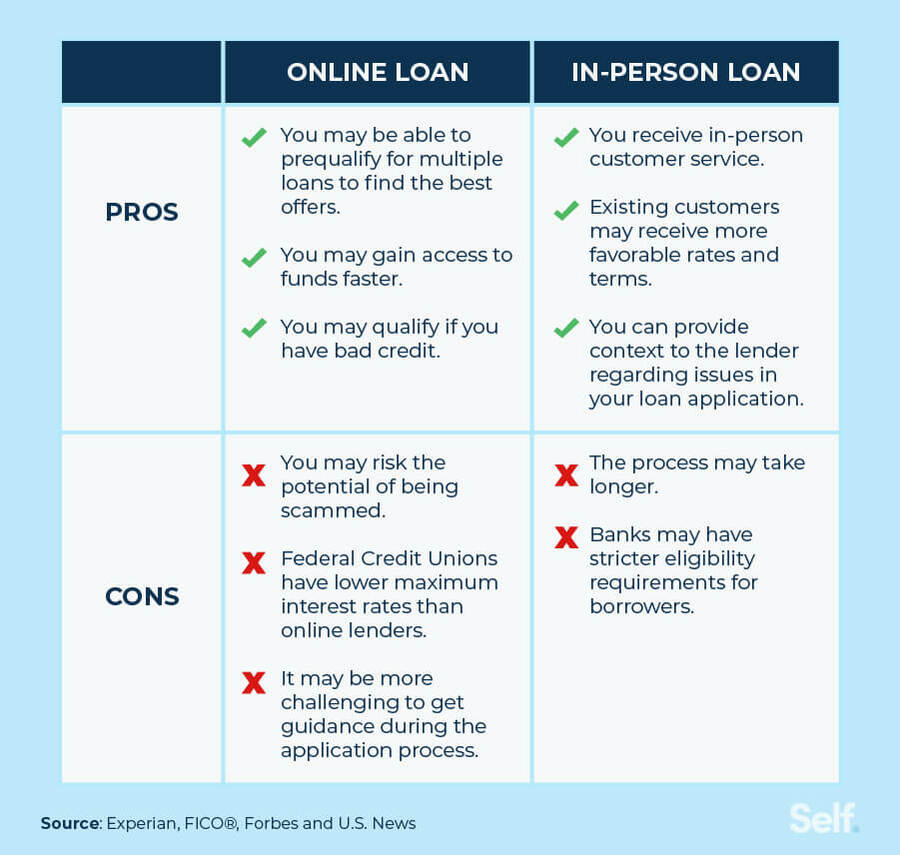

Credit: www.self.inc

Frequently Asked Questions

What Are Online Loans?

Online loans are financial products offered via the internet. They can be personal, business, or payday loans. Borrowers apply online, receive approval quickly, and often get funds faster than traditional banks. They are convenient and accessible, making them popular for many.

How Do Online Loans Work?

Online loans involve a straightforward process. You fill out an application on a lender’s website. Once submitted, the lender reviews your creditworthiness and decides on approval. If approved, funds are usually deposited directly into your bank account, often within a day or two.

What Are The Advantages Of Online Loans?

Online loans offer several advantages. They provide quick access to funds, often require less paperwork, and have flexible terms. Additionally, many lenders offer competitive interest rates. Borrowers can compare multiple offers easily, ensuring they find the best deal suited to their needs.

What Are The Disadvantages Of Online Loans?

Despite their benefits, online loans have disadvantages. They may come with higher interest rates compared to traditional banks. Some lenders might impose hidden fees. Additionally, the speed of approval can lead to impulsive borrowing, potentially resulting in financial strain.

Conclusion

Online loans offer quick access to funds and convenience. Yet, they come with higher interest rates and potential debt traps. It’s essential to weigh these pros and cons carefully. Understanding your financial situation will help you make informed choices. Always consider alternatives before committing to an online loan.

you’re really a good webmaster. The website loading speed is amazing. It seems that you are doing any unique trick. In addition, The contents are masterpiece. you’ve done a wonderful job on this topic!