**Car Insurance Tips:** Always shop around for the best rates and understand your policy’s coverage. Consider increasing your deductible to lower premiums.

Navigating the world of car insurance can feel overwhelming. With numerous options and varying rates, it’s crucial to find the right coverage that fits your needs. Understanding your policy is essential, as it dictates what is covered in case of an accident.

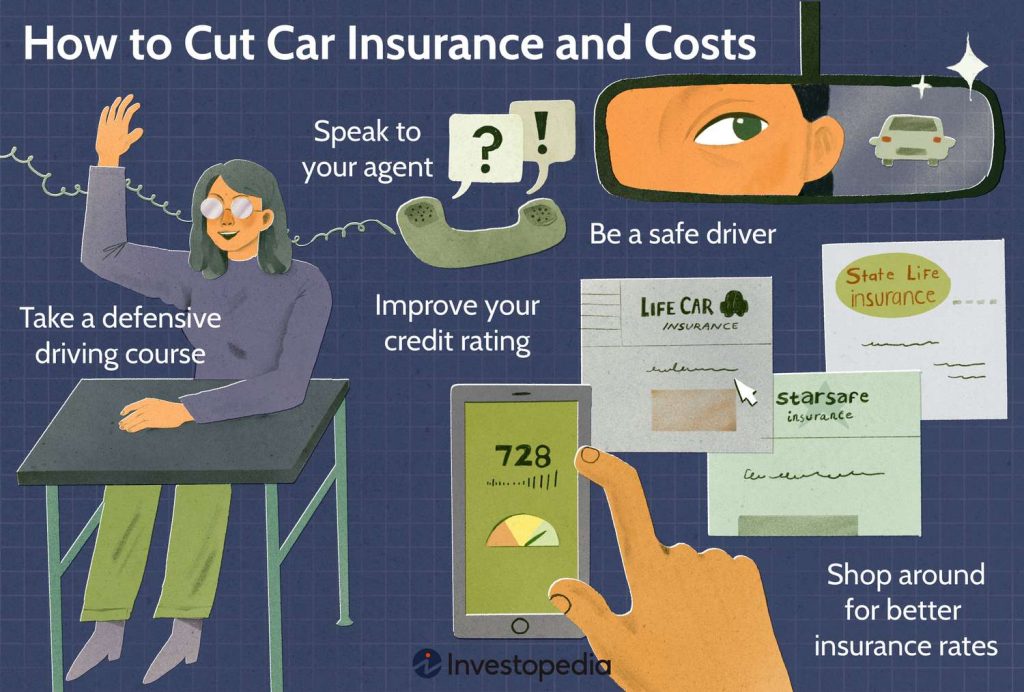

Many factors influence your insurance rates, including your driving history, vehicle type, and location. Taking proactive steps, such as shopping around and comparing quotes, can lead to significant savings. Implementing safety measures, such as defensive driving courses, not only enhances your driving skills but can also earn you discounts. This guide aims to provide valuable tips to optimize your car insurance experience effectively.

Maximizing Discounts: Smart Savings

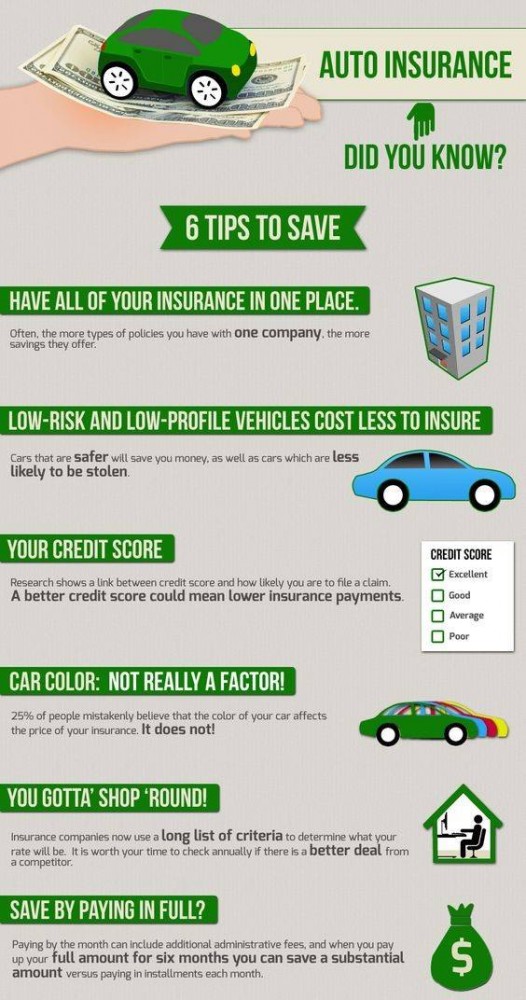

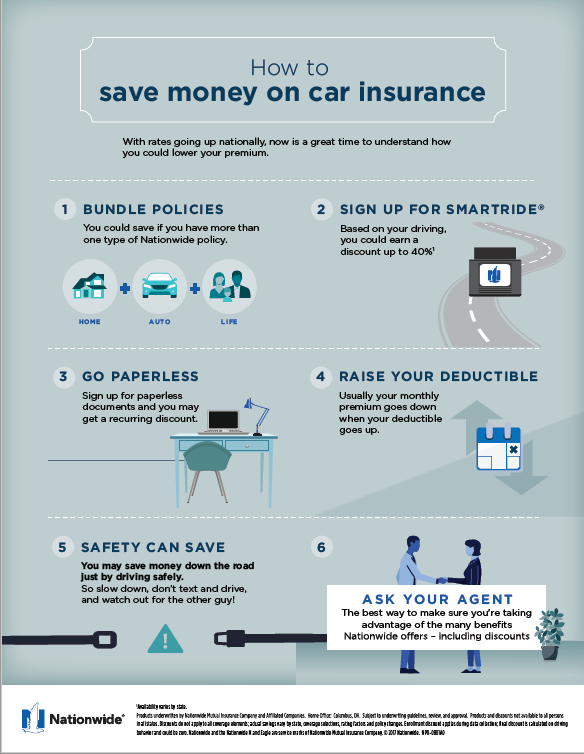

Saving money on car insurance is crucial. Many companies offer discounts that can lower your premium. Understanding these discounts helps you maximize your savings. Let’s explore some smart ways to cut costs.

Loyalty Rewards And Bundling Options

Insurance companies often reward loyal customers. Staying with the same provider can lead to significant discounts over time. Here’s how to make the most of it:

- Ask about loyalty programs: Many insurers offer perks for long-term customers.

- Check for bundling options: Combine auto insurance with home or renters insurance.

- Compare bundled rates: Sometimes, bundling saves you more than separate policies.

Occupational And Organizational Discounts

Your profession or membership can unlock additional savings. Many insurance providers offer specific discounts based on your job or affiliations. Here’s a list of common options:

| Occupation/Organization | Potential Discount |

|---|---|

| Teachers | Up to 10% off |

| Military Personnel | Up to 15% off |

| Healthcare Workers | Up to 10% off |

| Members of Certain Organizations | Varies by organization |

Always inquire about discounts related to your profession or memberships. You might be surprised by the savings available.

Maximizing discounts can significantly reduce your car insurance costs. Stay informed and proactive to enjoy these smart savings.

Credit: cobbleinsurance.com

Deductible Strategies: Balancing Risk And Cost

Understanding deductible strategies is vital for managing car insurance costs. A deductible is the amount you pay out of pocket before your insurance kicks in. Finding the right balance between risk and cost can save you money. Here are some effective strategies to consider.

Higher Deductibles For Lower Premiums

Choosing a higher deductible often leads to lower premiums. This means you pay less each month for coverage. Here are some points to consider:

- Higher deductibles can decrease your insurance costs.

- You need to pay more upfront in an accident.

- It’s essential to evaluate your financial situation.

Consider the following table to understand potential savings:

| Deductible Amount | Monthly Premium |

|---|---|

| $500 | $150 |

| $1,000 | $120 |

| $2,000 | $100 |

A higher deductible can lead to significant savings over time. Just ensure you have enough funds to cover the deductible if you need to file a claim.

Emergency Fund To Offset Deductible Increase

Building an emergency fund can help manage higher deductibles. This fund can cover unexpected costs without financial strain. Here are some tips to create an emergency fund:

- Set a specific savings goal.

- Open a dedicated savings account.

- Contribute a small amount regularly.

- Use windfalls like bonuses or tax refunds.

Aiming for at least $1,000 is a good start. This amount can cover most common deductibles. With an emergency fund, you can confidently choose a higher deductible.

Balancing risk and cost in your car insurance is essential. Evaluate your needs and prepare for unexpected expenses to make informed decisions.

Coverage Tailoring: Cut The Excess

Car insurance is essential for protecting your vehicle and finances. Tailoring your coverage helps you pay only for what you need. This approach can reduce costs significantly. Let’s explore how to reassess your coverage needs and determine when to drop comprehensive and collision coverage.

Reassessing Coverage Needs Periodically

Review your insurance policy regularly. Changes in your life can affect your coverage needs. Consider the following factors:

- Age of your vehicle: Older cars may not need full coverage.

- Driving habits: Less driving can lower your risk.

- Financial situation: Your budget may change over time.

- Location: Moving to a safer area may reduce risk.

Set a reminder to check your policy annually. This helps ensure your coverage matches your current needs. Adjustments can lead to lower premiums.

When To Drop Comprehensive And Collision

Deciding to drop comprehensive and collision coverage can save money. Consider these points:

| Situation | Action |

|---|---|

| Car’s value is low | Consider dropping collision coverage |

| High deductible | Evaluate if it’s worth keeping |

| Car is paid off | Think about dropping comprehensive coverage |

| Driving less frequently | Assess the need for full coverage |

Make informed choices based on your vehicle’s condition and your financial situation. Cutting unnecessary coverage can lead to significant savings.

Credit: investopedia.com

Comparative Shopping: Finding The Best Deals

Finding the best car insurance deals can save you money. Comparative shopping is essential. It helps you compare prices and coverage. Here are some effective strategies to get the best rates.

Annual Insurance Rate Check

Checking your insurance rate annually is crucial. Rates change, and you may find better options.

- Assess your current coverage.

- Check for new discounts.

- Evaluate your driving habits.

Many factors affect your rate:

| Factor | Impact on Rate |

|---|---|

| Driving Record | High impact |

| Credit Score | Moderate impact |

| Vehicle Type | High impact |

| Location | Moderate impact |

Review these factors regularly. This helps you understand your insurance needs.

Using Online Comparison Tools

Online comparison tools make shopping easier. They allow you to see multiple quotes quickly.

- Enter your details on comparison websites.

- Review different quotes in one place.

- Check the coverage options carefully.

Benefits of using these tools:

- Saves time and effort.

- Finds the lowest rates available.

- Compares coverage easily.

Popular comparison sites include:

- Geico

- Progressive

- The Zebra

Utilizing these tools can lead to significant savings. Always read the fine print before choosing a policy.

Driving Habits: Lower Premiums For Safe Drivers

Safe driving habits play a vital role in lowering your car insurance premiums. Insurers reward drivers who demonstrate responsibility and caution on the road. By improving your driving skills and reducing risks, you can save money on your insurance policy.

Defensive Driving Courses

Taking a defensive driving course can lead to significant savings on your car insurance. These courses teach essential techniques to avoid accidents and respond to dangerous situations.

- Enhanced Skills: Learn how to anticipate potential hazards.

- Insurance Discounts: Many insurers offer discounts for course completion.

- Improved Safety: Gain confidence in your driving abilities.

Check with your insurer about their specific discount for completing a defensive driving course. Keep a copy of your completion certificate to submit for the discount.

Benefits Of A Low-mileage Lifestyle

Driving less can lead to lower insurance costs. Many insurance companies reward low-mileage drivers with reduced premiums.

| Mileage Range | Potential Discount |

|---|---|

| 0 – 5,000 miles | Up to 20% |

| 5,001 – 10,000 miles | 10% – 15% |

| 10,001 – 15,000 miles | 5% – 10% |

Consider carpooling, using public transport, or biking to reduce mileage. Less driving means fewer chances for accidents, directly benefiting your insurance rates.

Credit: www.rightsure.com

Credit Score And Insurance: The Hidden Connection

Your credit score plays a key role in determining your car insurance rates. Insurers often use credit scores to assess risk. A higher score may lead to lower premiums. Understanding this connection can help you save money.

Improving Credit For Better Rates

Improving your credit score can lower your insurance costs. Here are simple steps to boost your score:

- Pay bills on time: Late payments harm your credit.

- Reduce debt: Lower balances improve your score.

- Limit new credit requests: Too many inquiries can hurt your score.

- Keep old accounts: Longer credit history benefits your score.

Even small changes can have a big impact on your rates.

Monitoring Credit Reports

Regularly checking your credit report is essential. It helps you spot errors and track progress. Follow these steps to monitor your credit:

- Request a free credit report from major bureaus.

- Review it for mistakes or unfamiliar accounts.

- Dispute any inaccuracies quickly.

- Use credit monitoring services for alerts.

Keeping a close eye on your credit can lead to better rates and more savings.

Vehicle Choice: Selecting Insurance-friendly Cars

Choosing the right vehicle can significantly impact your car insurance costs. Some cars are more expensive to insure than others. Understanding how your vehicle choice affects premiums helps you save money. This section highlights key factors to consider when selecting an insurance-friendly car.

How Car Models Impact Premiums

The make and model of your car can greatly influence your insurance rates. Insurers assess various factors that determine risk levels. Here are some considerations:

- Repair Costs: High-end models often have expensive parts, raising premiums.

- Theft Rates: Popular cars for thieves can lead to higher insurance costs.

- Engine Size: Powerful engines may increase the likelihood of accidents.

- Vehicle Type: SUVs and trucks may cost more to insure than sedans.

Insurance companies often categorize vehicles based on their risk profiles. Cars with lower risk levels usually have lower premiums. Consider these factors when making your purchase.

Considering Safety Features And Ratings

Safety features and ratings play a crucial role in determining your insurance costs. Vehicles equipped with advanced safety technology often qualify for discounts. Here are some essential safety features:

| Safety Feature | Description | Insurance Benefit |

|---|---|---|

| Anti-lock Brakes | Prevents wheels from locking during braking. | Lower premiums due to reduced accident risk. |

| Airbags | Protects occupants in case of a collision. | May lead to discounts based on safety ratings. |

| Electronic Stability Control | Helps maintain vehicle control during slippery conditions. | Reduces accident likelihood, lowering insurance costs. |

Check safety ratings from organizations like the IIHS or NHTSA. Higher safety ratings can lead to lower premiums. Investing in a safer vehicle pays off in the long run.

Usage-based Insurance: Pay-as-you-drive Options

Usage-Based Insurance (UBI) offers a new way to save on car insurance. It allows drivers to pay based on their actual driving habits. This option is perfect for those who drive less frequently. With UBI, your premium reflects your driving behavior, making it fairer for everyone.

Understanding Telematics Devices

Telematics devices track your driving habits. These small devices connect to your car’s onboard computer. They monitor:

- Speed

- Braking patterns

- Acceleration

- Time of day driven

Insurance companies use this data to calculate your premium. Safe drivers often receive discounts. Some common telematics devices include:

| Device | Description |

|---|---|

| Plug-in Devices | Plug into your car’s OBD-II port. |

| Mobile Apps | Track driving via your smartphone. |

Advantages For Infrequent Drivers

Infrequent drivers can benefit greatly from UBI. Here are some key advantages:

- Lower Premiums: Pay only for the miles you drive.

- Safe Driving Rewards: Get discounts for good driving habits.

- Flexible Payments: Adjust your payment based on usage.

- Encouragement for Safe Driving: Monitor your driving to improve safety.

These factors make UBI an attractive option. It provides a cost-effective solution for those who drive less.

Frequently Asked Questions

What Are 3 Important Tips On Filing An Auto Insurance Claim?

1. Review your policy details before filing a claim. 2. Collect all relevant information, including photos and witness statements. 3. Notify your insurance company promptly to start the claims process.

What Are 3 Factors That Lower Your Cost For Car Insurance?

Three factors that lower your car insurance costs include maintaining a clean driving record, choosing a vehicle with low repair costs, and improving your credit score. Each of these elements reduces perceived risk, leading to lower premiums. Always compare quotes for the best rates.

Is There A Way To Lower Car Insurance?

Yes, you can lower car insurance by qualifying for discounts, increasing your deductible, reducing coverage, comparing rates, and driving a safer vehicle. Taking a defensive driving course and opting for usage-based insurance can also help reduce premiums. Always shop around for the best rates.

How To Save Money On A Car Insurance Policy?

To save money on car insurance, shop around for the best rates. Take advantage of discounts and improve your driving record. Increase your deductible and consider dropping unnecessary coverage. Drive a car that’s cheaper to insure. Lastly, maintain a good credit score to lower your premiums.

Conclusion

Finding the right car insurance is essential for protecting yourself and your vehicle. By following these tips, you can save money while ensuring adequate coverage. Always compare rates and understand your policy. Take advantage of discounts and consider your driving habits.

Smart choices today can lead to better protection tomorrow.