**Car Insurance Tips:** Compare rates from different providers to find the best coverage for your needs. Consider increasing your deductible to lower your premium.

Navigating the world of car insurance can be daunting. With a variety of options available, it’s essential to understand how to secure the best coverage at an affordable price. Many factors influence insurance rates, such as your driving history, the type of vehicle, and your location.

By taking the time to shop around and evaluate multiple quotes, you can identify potential savings. Additionally, understanding your policy and knowing what discounts you qualify for can make a significant difference. This guide provides essential tips to help you make informed decisions and protect your investment while saving money on your car insurance.

Introduction To Smart Car Insurance Choices

Choosing the right car insurance can feel overwhelming. Many options exist, making it hard to know what fits best. Smart choices lead to better coverage and savings. Understanding key aspects of car insurance helps in making informed decisions.

Why Smart Choices Matter

Making smart choices in car insurance is crucial. Here are a few reasons:

- Financial Savings: A well-chosen policy can lower premiums.

- Better Coverage: Smart choices provide necessary protection.

- Peace of Mind: Knowing you’re covered in emergencies is reassuring.

- Custom Fit: Tailor your policy to your specific needs.

Understanding The Basics Of Car Insurance

Car insurance protects you from financial loss in accidents. Here are essential elements to know:

| Term | Description |

|---|---|

| Premium | The amount you pay for your insurance policy. |

| Deductible | The amount you pay out of pocket before insurance kicks in. |

| Coverage | The protection offered by your policy (e.g., liability, collision). |

| Exclusions | Specific situations not covered by your policy. |

Understanding these terms helps you make informed choices. Always read your policy carefully. Ask your agent if something is unclear.

Factors Influencing Car Insurance Rates

Understanding the factors that influence car insurance rates is crucial. Different aspects affect how much you pay. By knowing these factors, you can make informed choices. This knowledge helps in finding the best rates and coverage.

Age

Your age plays a significant role in your car insurance rate. Young drivers often pay higher premiums. Statistics show that drivers under 25 are more likely to be involved in accidents.

- Drivers aged 16-20: Highest rates

- Drivers aged 21-25: Still high rates

- Drivers aged 26-65: Generally lower rates

- Drivers over 65: Rates may increase again

Location

Your location can greatly impact your insurance costs. Urban areas usually have higher rates due to more traffic and accidents. Rural areas may have lower rates.

| Location Type | Rate Impact |

|---|---|

| Urban | Higher Rates |

| Suburban | Moderate Rates |

| Rural | Lower Rates |

Driving History

Your driving history is a key factor in determining your rates. A clean record leads to lower premiums. Accidents or tickets can increase your costs.

- No accidents: Best rates

- One accident: Moderate increase

- Multiple accidents: Significant increase

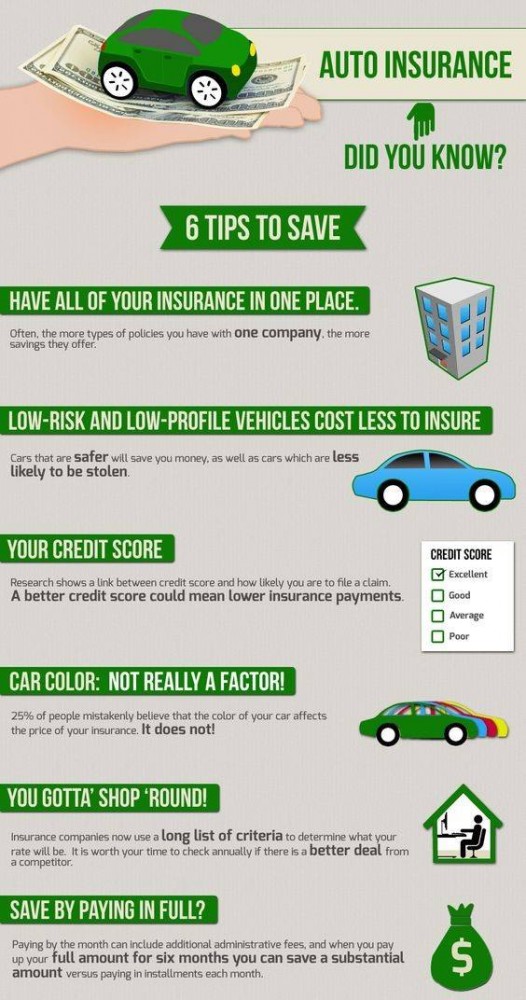

The Impact Of Credit Score

Your credit score also affects your car insurance rates. Insurers often use it to assess risk. A higher credit score usually leads to lower premiums.

- Excellent credit: Lowest rates

- Good credit: Competitive rates

- Fair credit: Higher rates

- Poor credit: Highest rates

Vehicle Type

The type of vehicle you drive influences your insurance cost. Sports cars and luxury vehicles typically cost more to insure.

| Vehicle Type | Insurance Cost |

|---|---|

| Sports Cars | Higher Cost |

| SUVs | Moderate Cost |

| Economy Cars | Lower Cost |

Strategies To Lower Your Car Insurance Costs

Car insurance can be expensive. Finding ways to reduce these costs is essential. Here are some effective strategies to help you save money on your car insurance premiums.

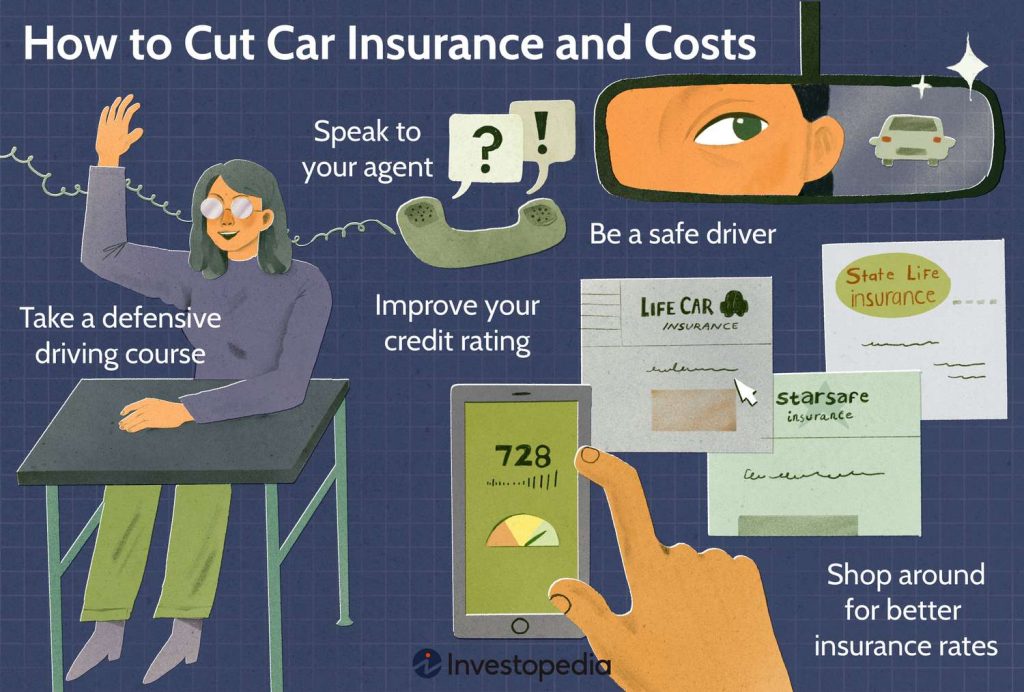

Qualifying For Insurance Discounts

Many insurance companies offer various discounts. These can significantly lower your premium. Here are some common discounts you might qualify for:

- Safe Driver Discount: No accidents or violations for a specified period.

- Multi-Policy Discount: Bundling home and auto insurance.

- Good Student Discount: Full-time students with good grades.

- Low Mileage Discount: Driving less than a certain number of miles.

- Defensive Driving Course Discount: Completing an approved course.

Check with your insurer to see which discounts apply to you. Ensure you ask about all possible savings. Every dollar counts!

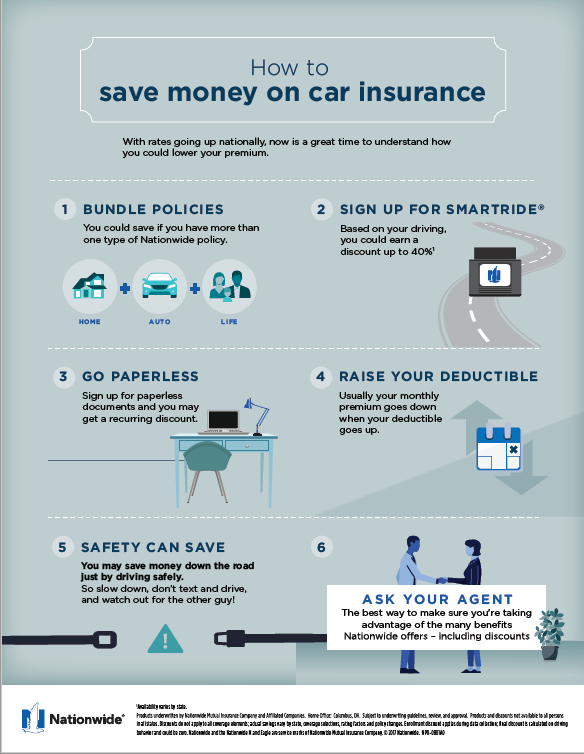

The Benefits Of Increasing Your Deductible

Raising your deductible can lower your premium. A higher deductible means you pay more out-of-pocket for claims. Here are some benefits:

- Lower Premiums: Monthly payments decrease significantly.

- Less Frequent Claims: Higher deductible encourages careful driving.

- Potential Savings: Long-term savings on premiums can be substantial.

Consider your budget before increasing your deductible. Make sure you can afford the higher out-of-pocket costs in case of an accident.

Credit: www.rightsure.com

Choosing The Right Coverage

Selecting the right car insurance coverage is crucial. It protects you financially. Understanding different coverage types helps you make informed choices.

Essential Coverage Vs. Optional Add-ons

Car insurance has two main types of coverage: essential and optional. Knowing the difference helps you save money.

| Coverage Type | Description | Importance |

|---|---|---|

| Liability Coverage | Covers damages to others in an accident. | Essential |

| Collision Coverage | Covers damage to your own vehicle. | Essential |

| Comprehensive Coverage | Covers non-collision-related damages. | Essential |

| Roadside Assistance | Provides help if your car breaks down. | Optional Add-on |

| Rental Car Reimbursement | Covers rental costs while your car is in the shop. | Optional Add-on |

Essential coverages protect you from major financial losses. Optional add-ons can enhance your policy but may increase costs.

When To Drop Unnecessary Coverage

Review your policy regularly to find unnecessary coverage. Consider the following factors:

- Car Value: If your car is old, drop collision and comprehensive coverage.

- Driving Habits: If you drive less, consider reducing coverage.

- Financial Situation: If you need to save money, drop optional add-ons.

Evaluate your needs. Make sure your policy matches your situation. Always consult your insurance agent for advice.

The Role Of Your Vehicle In Insurance Costs

Understanding how your vehicle affects your insurance costs is crucial. Different cars come with various risks. Insurers use these risks to set your premiums. Factors like safety ratings, repair costs, and theft rates play a big role. Choosing the right car can help you save money.

How Vehicle Choice Affects Premiums

Your car’s make and model directly impact your insurance premiums. Insurers analyze several factors:

- Safety Ratings: Cars with high safety ratings often cost less to insure.

- Repair Costs: Expensive cars may lead to higher premiums.

- Theft Rates: High theft rates increase your insurance costs.

- Engine Size: Powerful engines can mean higher risks and premiums.

Here’s a quick comparison:

| Vehicle Type | Average Premium |

|---|---|

| Compact Car | $1,200 |

| SUV | $1,500 |

| Luxury Car | $2,000 |

Cheaper-to-insure Cars

Some cars are cheaper to insure. These typically include:

- Compact cars with good safety ratings

- Vehicles with lower repair costs

- Models known for low theft rates

Here are some examples of cheaper-to-insure cars:

- Honda Civic

- Subaru Outback

- Toyota Corolla

Choosing one of these vehicles can lead to significant savings on your premiums.

Credit: investopedia.com

Maximizing Discounts And Savings

Finding ways to save on car insurance can be rewarding. Discounts can significantly lower your premium. Understanding how to maximize these discounts helps you keep more money in your pocket.

Leveraging Multi-policy Discounts

Bundling multiple insurance policies is a great way to save. Many companies offer discounts when you combine car and home insurance. Here are some key points:

- Save money: Discounts can reach up to 25%.

- Simplify payments: One payment for multiple policies.

- Increase coverage: Bundling often increases your coverage options.

Contact your insurance provider. Ask about available multi-policy discounts. Compare the savings you gain from bundling versus separate policies.

Defensive Driving Courses And Other Savings Tips

Taking a defensive driving course can lower your premium. Insurance companies reward safe drivers. Consider these tips:

- Enroll in a recognized defensive driving course.

- Ask your insurer about specific discounts for course completion.

- Maintain a clean driving record to qualify for additional discounts.

Other savings tips include:

- Increase your deductible to lower premiums.

- Review your policy annually for potential discounts.

- Utilize pay-per-mile insurance if you drive less.

Every little bit helps. Implement these strategies to enjoy lower rates and better coverage.

Understanding Usage-based Insurance

Usage-Based Insurance (UBI) offers a new way to save on car insurance. It tracks driving habits to determine rates. Safe drivers can enjoy lower premiums. This system uses telematics to monitor your driving behavior.

How Usage Impacts Insurance Rates

Insurance companies consider various factors to set rates. With UBI, the focus shifts to how you drive. Key factors include:

- Distance driven: More miles can mean higher risk.

- Speed: Speeding increases the likelihood of accidents.

- Braking: Sudden stops indicate aggressive driving.

- Time of day: Driving late at night can increase risk.

These factors help insurers assess your risk level. Lower risk means lower rates. Using UBI can lead to significant savings.

Benefits Of Telematics For Careful Drivers

Telematics devices monitor driving behaviors. They send data to insurance companies. Careful drivers can benefit greatly:

- Personalized rates: Pay for how you drive, not just your profile.

- Real-time feedback: Learn about your driving habits instantly.

- Potential discounts: Earn rewards for safe driving.

- Improved safety: Feedback can help you become a better driver.

Using telematics can be a smart choice. It encourages safer driving and offers financial benefits. Careful drivers can reap great rewards.

Shopping Around For The Best Rates

Finding the best car insurance rates requires effort. Shopping around can save you money. Different companies offer various rates. Each policy has unique features. Always compare multiple options before making a decision.

Comparing Insurance Quotes Online

Comparing insurance quotes online is quick and easy. Follow these steps to get started:

- Visit comparison websites.

- Enter your details like age and vehicle type.

- Review the quotes provided.

- Check for discounts available.

- Save your favorite quotes for later review.

Here’s a simple table showing average rates from different companies:

| Insurance Company | Average Annual Rate |

|---|---|

| Progressive | $1,200 |

| Allstate | $1,400 |

| Geico | $1,100 |

| State Farm | $1,300 |

Use these quotes to find the best deal. Rates can vary greatly. Always check for hidden fees or extra charges.

The Importance Of Reading And Understanding Your Policy

Reading your policy is essential. Understanding the terms helps avoid surprises later. Key points to focus on include:

- Coverage limits

- Deductibles

- Exclusions

- Claim process

Ask questions if something is unclear. Your agent is there to help. Knowing your policy ensures you have the coverage you need.

Stay informed about any changes in your policy. Review it annually to ensure it meets your needs.

Credit: cobbleinsurance.com

Frequently Asked Questions

What Are 3 Important Tips On Filing An Auto Insurance Claim?

To file an auto insurance claim effectively, follow these tips: 1. Review your insurance policy to understand your coverage. 2. Document the accident scene with photos and notes. 3. Report the incident to your insurer promptly, providing all necessary information.

What Are 3 Factors That Lower Your Cost For Car Insurance?

Three factors that can lower your car insurance cost include maintaining a clean driving record, opting for higher deductibles, and bundling insurance policies. Additionally, improving your credit score can also lead to lower premiums. Each of these strategies reduces your perceived risk to insurers.

Is There A Way To Lower Car Insurance?

Yes, you can lower car insurance by qualifying for discounts, increasing your deductible, reducing coverage, comparing rates, and driving a safer vehicle. Taking a defensive driving course and opting for usage-based insurance can also help reduce premiums. Regularly review your policy for potential savings.

How To Save Money On A Car Insurance Policy?

To save money on car insurance, compare quotes from different providers. Look for discounts and safe driving rewards. Increase your deductible and drop unnecessary coverage. Maintain a good credit score and consider usage-based insurance. Driving a less expensive car to insure can also reduce your premium.

Conclusion

Finding the right car insurance doesn’t have to be overwhelming. By following these tips, you can make informed decisions and potentially save money. Always compare quotes and understand your policy. Remember, the right coverage protects you and your vehicle. Stay proactive, and you’ll drive with confidence and peace of mind.