Blockchain significantly impacts fintech by enhancing security, speeding up transactions, and enabling decentralized applications. This technology is reshaping financial services, making them more efficient and accessible.

The integration of blockchain into fintech is revolutionizing how financial transactions occur. This technology offers a secure, transparent, and immutable ledger, reducing fraud and operational costs. Financial institutions now leverage blockchain for faster payments, smart contracts, and digital identity verification.

As a result, businesses can streamline their operations and improve customer experiences. The rise of decentralized finance (DeFi) platforms illustrates blockchain’s potential to democratize financial services, enabling users to access financial products without intermediaries. Exploring blockchain’s impact reveals its transformative role in creating a more efficient, inclusive, and innovative financial landscape.

Introduction To Blockchain In Fintech

Blockchain is changing the way we think about finance. This technology offers a secure and efficient method for transactions. It creates trust and transparency in the financial sector. Fintech companies are leveraging blockchain to enhance services. This combination of finance and technology is transforming the entire industry.

The Fusion Of Technology And Finance

The rise of fintech has brought technology and finance together. Traditional banking methods are evolving. Here are some key points about this fusion:

- Speed: Transactions are faster than ever.

- Cost: Reduced fees make services cheaper.

- Access: More people can access financial services.

- Innovation: New products and services are emerging.

Fintech companies use blockchain to create decentralized applications. These apps give users more control over their financial data. This shift leads to a more inclusive financial ecosystem.

Blockchain’s Role In Modern Fintech

Blockchain plays a vital role in modern fintech. It ensures security and transparency in transactions. Below are some ways blockchain impacts fintech:

| Aspect | Impact |

|---|---|

| Transaction Security | Immutable records reduce fraud. |

| Smart Contracts | Automatic execution of agreements. |

| Cost Reduction | Lower transaction fees for users. |

| Speed | Faster cross-border payments. |

Blockchain’s decentralized nature enhances user privacy. Users have control over their data. This leads to increased trust in financial services. The integration of blockchain in fintech is a game-changer.

Key Components Of Blockchain In Fintech

Blockchain technology is transforming the fintech landscape. Three main components drive this change: the blockchain ledger, smart contracts, and decentralized apps (dApps). Understanding these components is essential to grasp how blockchain enhances financial services.

Understanding Blockchain Ledger

The blockchain ledger acts as a digital record-keeper. It stores transactions in a secure and transparent manner. Here are the main features:

- Immutable: Once data is recorded, it cannot be altered.

- Distributed: Copies are available on multiple nodes.

- Transparent: All participants can view the same data.

This transparency builds trust among users. It also reduces the chances of fraud. The ledger’s security protects sensitive information, making it ideal for financial transactions.

The Significance Of Smart Contracts

Smart contracts automate and enforce agreements. They execute transactions once predefined conditions are met. Key benefits include:

- Efficiency: Reduces the need for intermediaries.

- Cost-effective: Lowers transaction fees.

- Accuracy: Minimizes human errors.

Smart contracts operate on the blockchain. They are secure, transparent, and reliable. Businesses can streamline operations and enhance customer satisfaction through these automated processes.

Exploring Decentralized Apps (dapps)

dApps run on a blockchain network, not a single server. They offer various services in the fintech industry. Benefits of dApps include:

- Decentralization: No single point of failure.

- User control: Users maintain ownership of their data.

- Interoperability: Can interact with other dApps and services.

These applications enhance user experience and security. They allow for innovative financial solutions like decentralized finance (DeFi) and peer-to-peer lending. dApps continue to shape the future of fintech.

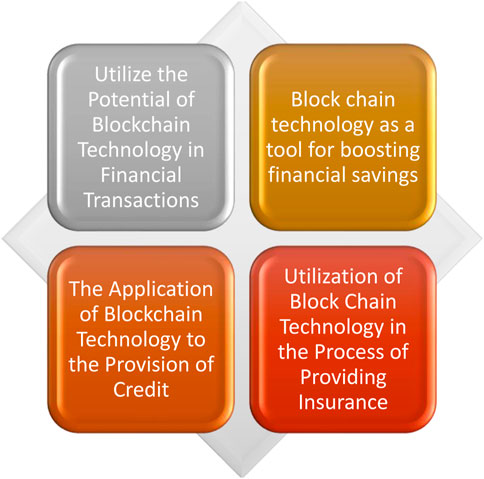

Revolutionizing Payments And Transactions

Blockchain technology is transforming how payments and transactions are handled. It offers enhanced security, speed, and cost-effectiveness. These benefits are reshaping the financial technology (fintech) landscape.

Enhancing Security And Speed

Security is a major concern in financial transactions. Blockchain provides a secure environment through encryption. Each transaction is recorded in a decentralized ledger. This makes fraud nearly impossible.

Transactions occur in real-time. Users enjoy instant confirmations without delays. Traditional banking systems often take hours or days for processing. Blockchain eliminates these delays, providing speed and convenience.

Reducing Costs And Improving Efficiency

Using blockchain can significantly lower transaction costs. Here are some key points:

- No middlemen required

- Lower fees for cross-border payments

- Reduced operational costs for businesses

Efficiency improves as blockchain automates many processes. Smart contracts execute automatically when conditions are met. This reduces the need for manual intervention.

Here is a simple table showing the benefits:

| Benefit | Traditional System | Blockchain System |

|---|---|---|

| Transaction Time | Hours/Days | Seconds/Minutes |

| Transaction Cost | High Fees | Low Fees |

| Security | Vulnerable | Highly Secure |

Overall, blockchain is a game-changer for payments and transactions. It boosts security, speed, and efficiency while cutting costs.

Blockchain’s Impact On Digital Identity Verification

Blockchain technology is transforming digital identity verification. It offers a secure and efficient way to manage personal information. This innovation addresses issues in traditional identity verification methods, making them more reliable.

Digital identity verification is crucial for financial services. It helps establish trust between customers and institutions. With blockchain, this process becomes faster and safer, benefiting both users and businesses.

Streamlining Kyc/aml Processes

Know Your Customer (KYC) and Anti-Money Laundering (AML) processes are essential in finance. Blockchain simplifies these processes significantly. Here’s how:

- Decentralization: Data is stored on a public ledger.

- Transparency: All transactions are visible and verifiable.

- Immutability: Once data is recorded, it cannot be changed.

Traditional KYC/AML processes can take weeks. Blockchain reduces this time to mere minutes. Companies can access verified information instantly. This leads to faster onboarding for customers.

A table below shows the differences between traditional and blockchain-based KYC/AML processes.

| Aspect | Traditional Process | Blockchain Process |

|---|---|---|

| Timeframe | Weeks | Minutes |

| Data Storage | Centralized | Decentralized |

| Verification | Manual | Automated |

Improving Customer Experience

Blockchain enhances customer experiences in several ways. First, it builds trust. Customers know their data is secure. Second, it reduces friction in transactions.

- Quick Verification: Customers can verify their identity instantly.

- Lower Costs: Reduced fees for identity checks.

- Privacy Control: Users manage their own data.

These benefits lead to higher satisfaction rates. Customers enjoy faster services. They appreciate having control over their personal information.

Blockchain’s role in digital identity verification is significant. It streamlines processes and enhances user experiences. This makes it a game-changer in the fintech industry.

Tokenization Of Assets And Its Advantages

The tokenization of assets is a revolutionary concept in the fintech world. It transforms physical assets into digital tokens on a blockchain. This process allows for easier trading and ownership transfer. Investors can access a wider range of assets. It also reduces barriers to entry. This section explores the concept and its benefits.

Exploring The Concept Of Tokenization

Tokenization involves converting rights to an asset into a digital token. This token exists on a blockchain. Here are some key aspects:

- Increased liquidity: Easier buying and selling of assets.

- Fractional ownership: Investors can own a fraction of high-value assets.

- Transparency: Blockchain provides a clear ownership record.

- Security: Reduces fraud and enhances asset protection.

Common assets that can be tokenized include:

| Asset Type | Examples |

|---|---|

| Real Estate | Properties, land |

| Art | Paintings, sculptures |

| Stocks | Company shares |

| Commodities | Gold, oil |

Benefits For Investors And Issuers

Tokenization offers several benefits for both investors and issuers.

- Lower costs: Reduced transaction fees and middlemen.

- Accessibility: Smaller investments open opportunities for more people.

- Speed: Faster transactions compared to traditional methods.

- Global reach: Investors can access assets worldwide.

For issuers, the advantages include:

- Expanded funding options: Reach more investors.

- Improved compliance: Smart contracts can automate regulatory requirements.

- Enhanced marketing: Digital tokens can attract tech-savvy investors.

Credit: venngage.com

Smart Contracts And Their Role In Fintech

Smart contracts are transforming the financial technology landscape. These self-executing contracts run on blockchain technology. They automate processes and eliminate the need for intermediaries. Smart contracts ensure efficiency, security, and transparency in financial agreements.

Automating Financial Agreements

Smart contracts automate financial agreements. This saves time and reduces errors. Here are some key benefits:

- Speed: Transactions happen instantly.

- Cost-effective: No need for intermediaries.

- Accuracy: Reduces human errors.

For example, in loan agreements, smart contracts can:

- Automatically release funds upon meeting terms.

- Update payment schedules based on borrower behavior.

Reducing Fraud And Ensuring Transparency

Smart contracts enhance security and transparency in fintech. They store information on a secure blockchain. This makes it difficult for fraud to occur. Here are some ways they help:

| Feature | Benefit |

|---|---|

| Immutable records | Prevents alteration of contract terms. |

| Decentralization | Reduces reliance on a single authority. |

| Transparent transactions | All parties can verify contract execution. |

These features build trust among users. They pave the way for safer financial transactions. Smart contracts are indeed a game-changer in fintech.

Decentralized Finance (defi): A New Paradigm

Decentralized Finance, or DeFi, is reshaping how we view finance. It removes middlemen from financial transactions. This transformation empowers users with greater control over their funds. DeFi offers innovative services and products that challenge traditional finance. It leverages blockchain technology to enhance security and transparency.

Understanding Defi And Its Components

DeFi comprises several essential components that work together:

- Smart Contracts: Self-executing contracts with terms directly written into code.

- Decentralized Applications (dApps): Applications that run on a blockchain network.

- Liquidity Pools: Pools of tokens that enable trading without needing a centralized exchange.

- Stablecoins: Cryptocurrencies pegged to stable assets like the US dollar.

- Decentralized Exchanges (DEX): Platforms allowing peer-to-peer trading without intermediaries.

These components create a robust financial ecosystem. They offer users more options and flexibility. With DeFi, transactions occur 24/7 with lower fees.

Impact On Traditional Banking

DeFi challenges traditional banking in many ways:

- Accessibility: Anyone with internet access can participate.

- Lower Costs: Reduced fees due to the absence of intermediaries.

- Increased Transparency: All transactions are recorded on a public ledger.

- Financial Inclusion: Unbanked populations can access financial services.

Traditional banks must adapt to this new landscape. They face pressure to innovate. Customers demand more efficient, user-friendly solutions. DeFi is not just an option; it’s becoming the norm.

Challenges And Future Prospects

The integration of blockchain technology in fintech presents both exciting opportunities and significant challenges. Understanding these challenges helps stakeholders strategize effectively. Future prospects hinge on overcoming these hurdles.

Addressing Scalability And Regulatory Issues

Scalability is a major challenge for blockchain in fintech. Current blockchain networks struggle to handle a high volume of transactions quickly. This issue can lead to delays and increased transaction costs.

- High transaction times: Networks like Ethereum can slow down during peak usage.

- Cost implications: Increased transaction fees can deter users.

Regulatory issues also pose challenges. Governments worldwide are still figuring out how to regulate blockchain technology. This uncertainty can create a hesitant investment climate.

- Compliance: Companies face difficulties in meeting varying regulations.

- Legal frameworks: The lack of clear legal guidelines can hinder innovation.

| Challenge | Impact |

|---|---|

| Scalability | Slower transaction speeds and higher costs. |

| Regulatory uncertainty | Hesitant investments and stalled innovations. |

Predicting The Future Of Blockchain In Fintech

Despite challenges, the future of blockchain in fintech looks promising. Industry experts believe that advancements in technology can address current issues. Several trends may shape this future.

- Increased adoption: More companies will embrace blockchain solutions.

- Interoperability: Different blockchain systems will work together seamlessly.

- Enhanced security: Improved protocols will make transactions safer.

Innovation in blockchain can lead to new financial products. This evolution will enhance user experience and trust. Companies that adapt early may gain a competitive edge.

- DeFi growth: Decentralized finance will continue to expand.

- Smart contracts: More businesses will use smart contracts for automation.

Overall, the future of blockchain in fintech is bright. Overcoming challenges will unlock its full potential. This technology could redefine how financial transactions occur.

Frequently Asked Questions

What Role Does Blockchain Play In The Fintech Industry Overall?

Blockchain enhances the fintech industry by providing secure, transparent transactions. It streamlines payments, reduces fraud risks, and enables decentralized applications. Smart contracts and blockchain ledgers improve operational efficiency, making financial services faster and more reliable. This technology is a game-changer for modern finance.

How Is Blockchain Transforming The Gaming Industry?

Blockchain transforms the gaming industry by enhancing transparency and security. It allows true ownership of in-game assets through NFTs. Players can trade, sell, or use these assets across different games. Smart contracts streamline transactions, reducing fraud and increasing trust among players.

Overall, blockchain fosters a decentralized gaming ecosystem.

What Is The Impact Of Blockchain Technology On The Financial Services Industry?

Blockchain technology significantly enhances the financial services industry by increasing transaction speed and security. It reduces costs, mitigates fraud risks, and streamlines processes like lending and payments. This innovation fosters transparency and efficiency, revolutionizing traditional banking methods for a more efficient financial ecosystem.

Why Is Blockchain A Game Changer?

Blockchain is a game changer due to its transparency and security. It ensures tamper-proof records, enhancing trust among users. This technology streamlines processes, reduces costs, and increases efficiency across various industries. By enabling decentralized transactions, blockchain fosters innovation and disrupts traditional business models.

Conclusion

Blockchain is reshaping the fintech landscape in profound ways. Its ability to enhance security, speed, and transparency makes it a powerful tool for financial innovation. As the industry evolves, embracing blockchain will be crucial for companies aiming to stay competitive.

The future of fintech will undoubtedly be driven by this groundbreaking technology.