To choose the right loan, assess your financial needs and compare options side by side. Focus on interest rates, loan amounts, and repayment terms to make an informed decision.

Selecting the right loan can significantly impact your financial future. With various options available, understanding your unique needs is crucial. Different loans cater to different purposes, whether for buying a home, financing education, or managing unexpected expenses. Each type comes with specific terms, interest rates, and fees.

Taking time to research and compare loans will help you find the best fit for your situation. By evaluating your financial health, assessing eligibility, and considering long-term goals, you can make a confident choice that aligns with your lifestyle and aspirations.

Identifying Your Financial Goals

Choosing the right loan starts with understanding your financial goals. Knowing what you want to achieve helps you select the best loan option. Clear goals guide your decision-making process. They help you assess which type of loan fits your needs.

Short-term Vs Long-term Objectives

Financial goals can be classified into two categories: short-term and long-term. Each category has distinct characteristics and purposes.

| Type of Goal | Description | Loan Types |

|---|---|---|

| Short-term | Goals achieved within 1-3 years. | Personal loans, payday loans |

| Long-term | Goals achieved in 3 years or more. | Mortgage loans, student loans |

Short-term objectives often involve immediate needs. These may include:

- Paying off credit card debt

- Covering unexpected medical bills

- Funding a short vacation

Long-term objectives focus on larger goals. Examples include:

- Buying a home

- Paying for college education

- Building a business

Evaluating Your Financial Health

Your financial health plays a crucial role in loan selection. Assessing your current situation helps you make informed choices.

- Check Your Credit Score: A higher score leads to better loan terms.

- Calculate Monthly Income: Ensure your income covers loan payments.

- Review Existing Debts: Understand how much you owe before taking on new loans.

- Estimate Expenses: Include all essential expenses in your calculations.

Understanding your financial health helps you see what you can afford. It ensures you don’t take on more debt than you can handle. This evaluation leads to better loan choices.

Credit: luminarc.su

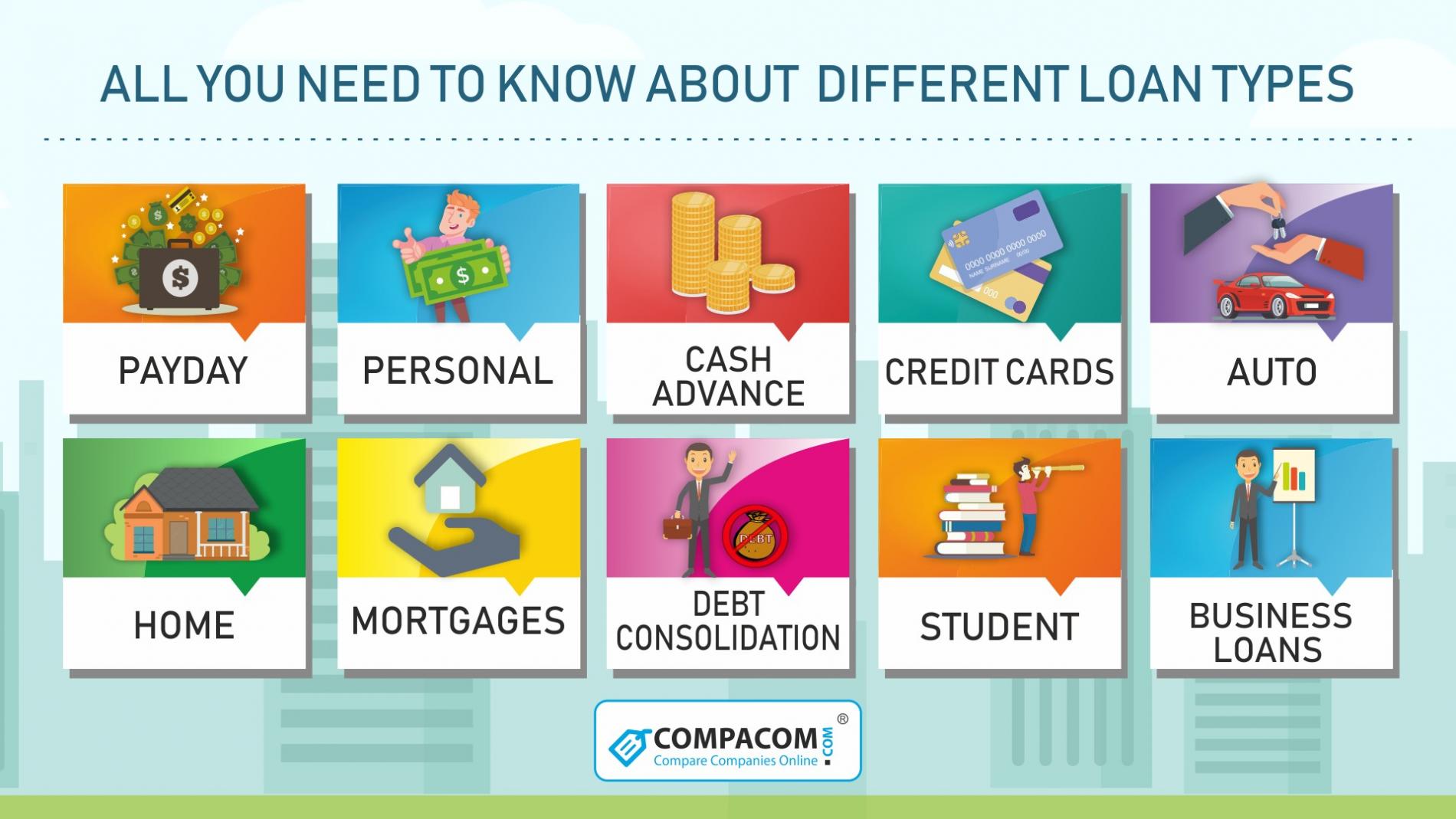

Understanding Different Loan Types

Choosing the right loan requires knowledge of various types. Each loan serves different financial needs. Understanding these types helps in making informed decisions. Below, we explore secured vs unsecured loans and fixed-rate vs variable-rate loans.

Secured Vs Unsecured Loans

Secured loans require collateral, such as a house or car. If the borrower fails to repay, the lender can seize the collateral. These loans typically have lower interest rates. They are ideal for those with assets to back the loan.

Unsecured loans do not require collateral. Lenders base approval on creditworthiness. These loans usually have higher interest rates. They are suitable for borrowers without assets to pledge.

| Loan Type | Collateral Required | Interest Rates | Typical Uses |

|---|---|---|---|

| Secured Loans | Yes | Lower | Home, Auto Financing |

| Unsecured Loans | No | Higher | Personal Expenses, Credit Cards |

Fixed-rate Vs Variable-rate Loans

Fixed-rate loans have an interest rate that stays the same. Monthly payments remain constant throughout the loan’s life. This provides predictability in budgeting.

Variable-rate loans have interest rates that can change. Payments may increase or decrease over time. These loans can start with lower rates but may become more expensive. They are often chosen for short-term borrowing.

- Fixed-rate loans:

- Stable payments

- Good for long-term budgeting

- Variable-rate loans:

- Potential for lower initial rates

- Higher risk with changing payments

Assessing Your Creditworthiness

Understanding your creditworthiness is key in choosing the right loan. Your creditworthiness determines your loan options and interest rates. A good credit score can lead to better loan terms. Knowing how to assess your creditworthiness helps you make informed financial decisions.

The Role Of Credit Scores

Your credit score plays a vital role in lending decisions. This score reflects your credit history. Lenders use it to evaluate risk. Here are key points about credit scores:

- Range: Scores typically range from 300 to 850.

- Categories:

- Excellent: 750 and above

- Good: 700 – 749

- Fair: 650 – 699

- Poor: Below 650

- Factors:

- Payment history (35%)

- Credit utilization (30%)

- Length of credit history (15%)

- Types of credit (10%)

- New credit inquiries (10%)

Improving Your Credit Score For Better Terms

A higher credit score leads to better loan terms. Here are steps to improve your score:

- Pay bills on time: Late payments hurt your score.

- Reduce debt: Aim for low credit utilization.

- Check your credit report: Look for errors.

- Avoid opening new accounts: Too many inquiries can lower your score.

- Consider becoming an authorized user: This can boost your score.

Improving your credit score takes time. Focus on small, consistent actions. Your efforts can lead to significant savings on loan costs.

Comparing Loan Offers

Finding the right loan can be overwhelming. Comparing different loan offers helps you make informed choices. Focus on key factors like interest rates, terms, and fees. Understanding these elements will lead to better decisions.

Interest Rates And Apr

Interest rates determine how much you’ll pay over time. The Annual Percentage Rate (APR) includes interest and fees. Here’s how to compare:

| Lender | Interest Rate | APR |

|---|---|---|

| Lender A | 4.5% | 4.8% |

| Lender B | 5.0% | 5.2% |

| Lender C | 4.0% | 4.3% |

Lower interest rates and APRs mean lower costs. Always check these rates from multiple lenders.

Terms And Conditions Analysis

Understanding loan terms is vital. Look for:

- Loan Amount: Ensure it meets your needs.

- Loan Term: Shorter terms often mean higher payments.

- Prepayment Penalties: Check if you can pay off early.

- Fees: Look for hidden fees that increase costs.

Read all terms carefully. Ask questions if something is unclear. Knowing these details helps you avoid surprises.

Calculating The Total Cost

Understanding the total cost of a loan is crucial. This involves more than just the amount borrowed. It includes various components like principal, interest, and fees. Each element can significantly affect your financial situation.

Principal

The principal is the original amount borrowed. It is the foundation of your loan. Here are key points to remember:

- The principal amount determines your monthly payment.

- A higher principal leads to higher payments.

- Reducing the principal amount lowers total interest paid.

Example:

| Loan Amount | Monthly Payment |

|---|---|

| $10,000 | $200 |

| $5,000 | $100 |

Interest

Interest is the cost of borrowing money. Lenders charge interest as a percentage of the principal. Important factors include:

- Interest rates vary between lenders.

- Fixed rates stay the same; variable rates can change.

- Lower interest rates reduce overall loan cost.

Example Calculation:

Loan Amount: $10,000 Interest Rate: 5% Total Interest Paid: $10,000 0.05 = $500

The Impact Of Loan Terms On Total Payment

Loan terms refer to the length of time you have to repay. Longer terms lower monthly payments but increase total interest paid. Shorter terms have higher payments but less interest. Here are some insights:

- 5-year loans often have lower total interest.

- 30-year loans spread payments out over time.

- Choosing the right term is essential for budgeting.

Compare two terms:

| Loan Term | Monthly Payment | Total Interest Paid |

|---|---|---|

| 5 Years | $200 | $500 |

| 30 Years | $100 | $2,000 |

Considering Additional Fees

Understanding the fees associated with a loan is crucial. These costs can significantly affect your overall financial commitment. Always consider the origination fees and any prepayment penalties before making a decision. Awareness of these expenses can save you money and stress in the long run.

Origination Fees

Origination fees are charged by lenders for processing your loan application. This fee usually ranges from 0.5% to 1% of the total loan amount. Here are some key points to remember:

- Always ask about the origination fee upfront.

- Compare fees from different lenders.

- Negotiate the fee if possible.

- Check if the fee can be rolled into the loan amount.

Understanding origination fees can help you choose a better loan. Here’s a simple table to illustrate how these fees can add up:

| Loan Amount | Origination Fee (1%) |

|---|---|

| $10,000 | $100 |

| $20,000 | $200 |

| $30,000 | $300 |

Prepayment Penalties

Prepayment penalties are fees charged if you pay off your loan early. Not all loans have these penalties. Here are important facts to consider:

- Read the loan agreement carefully.

- Ask the lender about prepayment penalties.

- Consider loans without prepayment penalties for more flexibility.

These penalties can impact your financial plans. Understanding them is essential before committing to a loan. Below is a quick comparison:

| Loan Type | Prepayment Penalty |

|---|---|

| Fixed-Rate Mortgage | Often No |

| Adjustable-Rate Mortgage | Sometimes Yes |

| Personal Loans | Varies |

Evaluating these additional fees helps you make an informed choice. Always factor in these costs when selecting the right loan for your financial needs.

Prequalification Process

The prequalification process is a vital step in securing a loan. It helps you understand what loans you qualify for before applying. This process can save time and reduce stress. Knowing your options early is beneficial. Let’s explore the benefits and how to apply.

Benefits Of Prequalification

- Understand Loan Options: Prequalification shows what loans you can access.

- Estimate Budget: Knowing your limits helps set a budget.

- Strengthen Negotiation: A prequalified status boosts your position with lenders.

- Save Time: Focus on loans that fit your financial situation.

- Know Your Credit Standing: Get insights into your credit score impact.

How To Apply For Prequalification

Applying for prequalification is a straightforward process. Follow these steps:

- Research Lenders: Compare different lenders to find the best fit.

- Gather Documents: Prepare necessary documents like income proof and credit history.

- Fill Out Application: Complete the prequalification application online or in person.

- Submit Information: Provide accurate details to avoid delays.

- Review Results: Analyze the prequalification offers you receive.

Prequalification is a simple way to gain clarity on your loan options. It sets a solid foundation for your financial journey.

Credit: fastercapital.com

Seeking Professional Advice

Choosing the right loan can be overwhelming. Seeking professional advice can simplify this process. Financial advisors can provide tailored guidance. They help you understand your options. This ensures you make informed decisions that suit your needs.

When To Consult A Financial Advisor

Consult a financial advisor in these situations:

- You are unsure about your financial situation.

- You want to understand different loan types.

- You are considering a large purchase, like a home.

- Your credit score needs improvement.

- You have multiple debts and need a strategy.

These experts can analyze your financial health. They offer personalized advice based on your goals.

Resources For Free Financial Counseling

Access free financial counseling through various resources:

| Resource | Description | Website |

|---|---|---|

| National Foundation for Credit Counseling | Offers free credit counseling services. | nfcc.org |

| Consumer Financial Protection Bureau | Provides tools and tips for financial management. | consumerfinance.gov |

| Financial Planning Association | Connects consumers with certified planners. | plannersearch.org |

These organizations provide valuable support. They help you navigate your financial journey.

Frequently Asked Questions

How Do I Know What Loan Is Right For Me?

To find the right loan, assess your financial needs and goals. Compare interest rates, terms, and monthly payments. Consider fees and the total cost over time. Prequalify with multiple lenders to understand your options better. This process will help you make an informed decision.

How To Decide Which Personal Loan Is Best?

To choose the best personal loan, compare interest rates, fees, and repayment terms. Assess your financial needs and eligibility. Prequalify with multiple lenders to find the best deal. Prioritize options that align with your budget and future goals. Always read the fine print before committing.

How To Choose The Right Loan Lender?

To choose the right loan lender, compare interest rates, loan terms, and fees. Evaluate customer service and lender reputation. Check for flexibility in repayment options. Assess your financial needs and eligibility. Gather multiple quotes to ensure you select the best deal for your situation.

What Loans Are Based On Financial Need?

Loans based on financial need include subsidized student loans, certain personal loans, and community development loans. These options typically require documentation of income and expenses to determine eligibility. They aim to assist individuals facing financial hardships or pursuing education.

Conclusion

Choosing the right loan is essential for your financial health. By evaluating your needs, comparing options, and understanding the terms, you can make informed decisions. Remember to consider interest rates, fees, and repayment terms. A suitable loan can empower you to achieve your financial goals with confidence and ease.