To build a real estate portfolio, start by defining your investment goals and strategies. Next, acquire your first property, focusing on cash flow and location.

Creating a successful real estate portfolio requires a strategic approach. Investors should first clarify their objectives, whether it’s for passive income, appreciation, or diversification. Understanding the local market is crucial for identifying opportunities that align with your goals. Starting small helps mitigate risks while gaining valuable experience.

As your confidence and knowledge grow, consider expanding your portfolio with varied property types. This diversification can enhance stability and returns. Building a network of industry professionals, including agents and lenders, offers valuable insights and resources. Consistent education and market analysis keep your investment strategies effective and relevant.

Laying The Foundation

Building a successful real estate portfolio requires a solid foundation. This involves setting clear financial goals and assessing your starting capital. Without these steps, you may face difficulties as you grow your investments. Let’s dive into the essential components of laying that foundation.

Setting Financial Goals

Establishing financial goals is crucial for your real estate journey. Clear goals give direction and purpose. Consider these aspects:

- Short-term goals: Focus on immediate gains.

- Long-term goals: Aim for lasting wealth.

- Specific targets: Define income or property numbers.

Write down your goals. This creates accountability. Review them regularly to ensure you stay on track.

Assessing Your Starting Capital

Understanding your starting capital is vital. This includes cash, savings, and available credit. Evaluate your financial situation using the following steps:

- List all your savings and assets.

- Include any potential loans or investments.

- Calculate your total available capital.

Here’s a simple table to help you assess your starting capital:

| Asset Type | Value |

|---|---|

| Savings Account | $10,000 |

| Investment Accounts | $5,000 |

| Home Equity | $15,000 |

| Available Credit | $8,000 |

After calculating your starting capital, assess how much you can invest. Knowing your limits helps in making informed decisions.

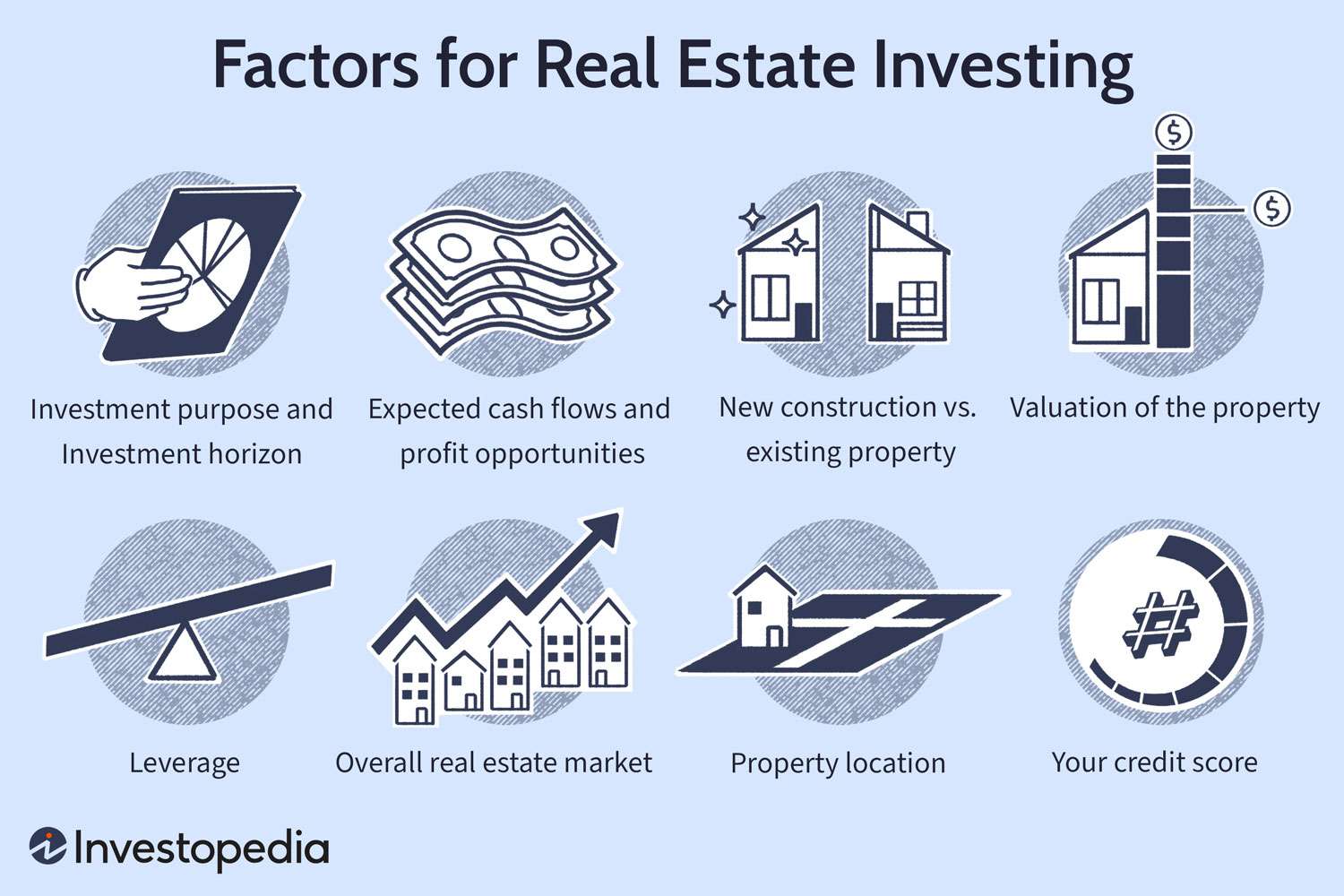

credit: investopedia.com

Education And Research

Building a successful real estate portfolio starts with proper education and thorough research. Understanding the basics of real estate and analyzing the local market helps investors make informed decisions. Let’s dive deeper into the essential aspects of education and research.

Learning The Real Estate Basics

Before investing, grasp the fundamental concepts of real estate. This knowledge sets the foundation for your portfolio. Here are key areas to focus on:

- Types of Properties: Know the different types such as residential, commercial, and industrial.

- Investment Strategies: Familiarize yourself with strategies like flipping, renting, and wholesaling.

- Financing Options: Understand traditional mortgages, hard money loans, and private lenders.

- Legal Aspects: Learn about contracts, zoning laws, and landlord-tenant rights.

Consider taking online courses or attending workshops. Many resources are available to help you gain knowledge quickly.

Analyzing The Local Market

Market analysis is crucial for successful investments. Understanding the local market helps you identify good opportunities. Here are steps to analyze your market:

- Research Neighborhood Trends: Study the growth patterns, demographics, and local amenities.

- Evaluate Property Values: Look at recent sales and property appreciation rates.

- Check Rental Rates: Analyze current rental prices and vacancy rates.

- Identify Investment Hotspots: Find areas with potential for high returns.

| Market Factor | What to Look For |

|---|---|

| Population Growth | Increasing population often leads to higher demand for housing. |

| Job Opportunities | Strong job markets attract new residents. |

| School Quality | Good schools can boost property values. |

| Local Amenities | Proximity to parks, shops, and public transport enhances appeal. |

Utilizing online tools and databases can simplify your research. Websites like Zillow and Realtor.com offer valuable data.

Investment Strategies

Building a successful real estate portfolio requires smart investment strategies. These strategies guide your choices and help grow your assets. Follow these steps to choose the best approach for you.

Choosing Your Real Estate Niche

Selecting a niche is vital for your success. A niche allows you to focus your efforts. It also helps you become an expert in that area. Here are some popular real estate niches:

- Residential Properties: Includes single-family homes and apartments.

- Commercial Properties: Involves office buildings, retail spaces, and warehouses.

- Vacation Rentals: Short-term rentals in tourist areas.

- Fix-and-Flip: Buy, renovate, and sell for profit.

- Real Estate Investment Trusts (REITs): Invest in real estate through stocks.

Understanding Different Investment Options

Explore various investment options to diversify your portfolio. Each option has unique benefits and risks. Here’s a breakdown:

| Investment Option | Description | Pros | Cons |

|---|---|---|---|

| Rental Properties | Owning properties to rent out | Steady cash flow, property appreciation | Management responsibilities, maintenance costs |

| Real Estate Crowdfunding | Pooling funds to invest in projects | Low entry cost, diversification | Less control, potential fees |

| REITs | Investing in real estate through stocks | Liquidity, professional management | Market volatility, limited control |

| Hard Money Loans | Short-term loans secured by real estate | Fast access to capital | Higher interest rates, risk of foreclosure |

Each investment option suits different investors. Assess your financial goals before choosing. This will help you build a strong, diversified real estate portfolio.

Financing Your Investments

Financing your real estate investments is crucial. It helps you acquire properties without draining your savings. Different financing options cater to various needs. Understanding these options can lead to better investment decisions.

Exploring Loan Options

Loans are a primary source of funding for real estate investments. Below are some common loan types:

| Loan Type | Description | Best For |

|---|---|---|

| Conventional Loans | Traditional financing through banks. | Stable income investors. |

| FHA Loans | Government-backed loans for low down payments. | First-time buyers. |

| Hard Money Loans | Short-term loans based on property value. | Flippers and quick sales. |

| Portfolio Loans | Loans held by lenders, not sold on secondary market. | Investors with multiple properties. |

Choose a loan type that fits your situation. Compare interest rates and terms. Make sure to read all loan agreements carefully.

Creative Financing Solutions

Creative financing can open doors to new opportunities. These methods may require less cash upfront. Here are a few options:

- Seller Financing: The seller acts as the lender.

- Lease Options: Rent with the option to buy later.

- Partnerships: Team up with others to share costs.

- House Hacking: Rent out part of your home.

- The BRRRR Method: Buy, Rehab, Rent, Refinance, Repeat.

These creative options can minimize risk and maximize returns. Each method has its pros and cons. Research each thoroughly before committing.

The First Purchase

The first purchase in real estate is a crucial step. This decision shapes your investment journey. Choosing wisely can set the stage for future success. Let’s explore how to make this vital decision.

Finding The Right Property

Finding the perfect property requires careful consideration. Here are key factors to guide you:

- Location: Choose an area with growth potential.

- Property Type: Decide between residential or commercial.

- Market Trends: Research local market conditions.

- Budget: Determine your price range.

- Potential ROI: Evaluate expected returns on investment.

Utilize online platforms to search for properties. Network with local agents for insights. Attend open houses to get a feel for the market.

Due Diligence And Making Offers

Before making an offer, conduct due diligence. This ensures a sound investment. Follow these steps:

- Inspect the Property: Hire a professional for a thorough inspection.

- Review Documents: Check title, zoning, and permits.

- Analyze Comparable Sales: Look at recent sales of similar properties.

- Calculate Costs: Factor in repairs, taxes, and fees.

Once satisfied, prepare to make an offer. Use the information gathered to justify your price. Be ready to negotiate. A strong offer can lead to successful acquisition.

Portfolio Expansion

Expanding your real estate portfolio is crucial for long-term success. It allows you to maximize profits and diversify investments. Focus on reinvesting profits and scaling your portfolio effectively. These steps help in gaining stability and growth in your real estate journey.

Reinvesting Profits

Reinvesting profits is one of the best strategies for portfolio growth. Use your earnings wisely to buy more properties. Consider these methods:

- Buy additional properties to enhance cash flow.

- Invest in renovations for existing properties to increase value.

- Join real estate investment groups for collaborative opportunities.

By reinvesting profits, you create a cycle of growth. Each new investment increases your potential income.

Scaling Your Portfolio

Scaling your portfolio involves strategic planning and execution. Follow these steps to scale effectively:

- Evaluate your current properties for performance and potential.

- Set clear financial goals for future investments.

- Research new markets for emerging opportunities.

- Utilize leverage to finance new purchases.

Consider using the table below to track your portfolio growth:

| Property | Purchase Price | Current Value | Equity |

|---|---|---|---|

| Property A | $200,000 | $250,000 | $50,000 |

| Property B | $150,000 | $180,000 | $30,000 |

| Property C | $300,000 | $350,000 | $50,000 |

Scaling your portfolio boosts your income and net worth. Always monitor market trends and adjust your strategy accordingly.

Risk Management

Managing risk is vital in real estate investing. It protects your assets and ensures steady growth. Understanding how to mitigate risks can save you money and stress. Focus on effective strategies to safeguard your investments.

Diversification Strategies

Diversification reduces risk by spreading investments across different properties. Here are some effective strategies:

- Property Types: Invest in residential, commercial, and industrial properties.

- Geographical Locations: Buy properties in various neighborhoods or cities.

- Investment Levels: Mix high-risk and low-risk properties.

- Investment Structures: Consider syndications, partnerships, and REITs.

By diversifying, you minimize the impact of any single investment’s poor performance.

Insurance And Legal Protection

Insurance and legal protection are key to managing risks. They shield your investments from unexpected events.

| Type of Insurance | Purpose |

|---|---|

| Property Insurance | Covers damages to your property. |

| Liability Insurance | Protects against lawsuits and claims. |

| Title Insurance | Protects against title disputes. |

| Flood Insurance | Covers damages from flooding. |

Consult a legal expert for contracts and agreements. Protect your assets with proper legal structures. This includes LLCs or partnerships.

Portfolio Management

Managing a real estate portfolio requires careful planning and execution. Good portfolio management helps you maximize your investments. It also aids in minimizing risks. Effective property management and long-term growth tactics are key components. Below are important strategies for managing your real estate portfolio.

Effective Property Management

Property management plays a vital role in your portfolio’s success. Here are some tips:

- Screen Tenants: Choose reliable tenants to ensure timely payments.

- Regular Maintenance: Keep properties in good condition to attract renters.

- Clear Communication: Maintain open lines with tenants for quick issue resolution.

- Track Finances: Use software for budgeting and tracking expenses.

Consider hiring a property management company if you have multiple properties. They can handle day-to-day tasks efficiently.

Long-term Growth Tactics

Focus on strategies that promote long-term growth. Here are effective tactics:

- Diversification: Invest in different types of properties. This spreads risk.

- Market Research: Analyze local markets to identify growth areas.

- Reinvestment: Use profits to buy more properties.

- Networking: Connect with other investors to share insights and opportunities.

Long-term growth requires patience and planning. Keep your goals clear and adjust strategies as needed.

| Tactic | Description |

|---|---|

| Diversification | Invest in various property types. |

| Market Research | Study trends and growth potential. |

| Reinvestment | Use profits to acquire more assets. |

| Networking | Collaborate with other investors. |

Frequently Asked Questions

How Do I Make A Real Estate Portfolio With Little Money?

To create a real estate portfolio with little money, consider these strategies: 1. Partner with investors to share costs. 2. Explore seller financing options. 3. Utilize lease options for rental properties. 4. Try house hacking to reduce living expenses. 5.

Invest in REITs for passive income.

How To Build A Real Estate Portfolio For Passive Income?

To build a real estate portfolio for passive income, start by researching your market. Invest in rental properties or REITs. Focus on cash flow and property appreciation. Diversify your investments to minimize risk. Regularly reassess your portfolio to ensure it meets your income goals.

What Are The Four Steps To Build A Portfolio?

To build a portfolio, follow these four steps: 1. Define your goals and investment strategy. 2. Research and select the right assets. 3. Create a diversified portfolio to minimize risk. 4. Regularly review and adjust your investments.

How Do I Start Building My Portfolio?

Start by defining your goals and target market. Gather examples of your best work or projects. Create an online presence using a website or social media. Network with industry professionals and seek feedback. Continuously update and refine your portfolio as you gain more experience.

Conclusion

Building a real estate portfolio requires careful planning and strategic actions. Each step brings you closer to financial freedom and wealth generation. Stay informed, adapt to market changes, and continuously learn. With dedication and the right strategies, you can create a diverse portfolio that stands the test of time.

Start your journey today!