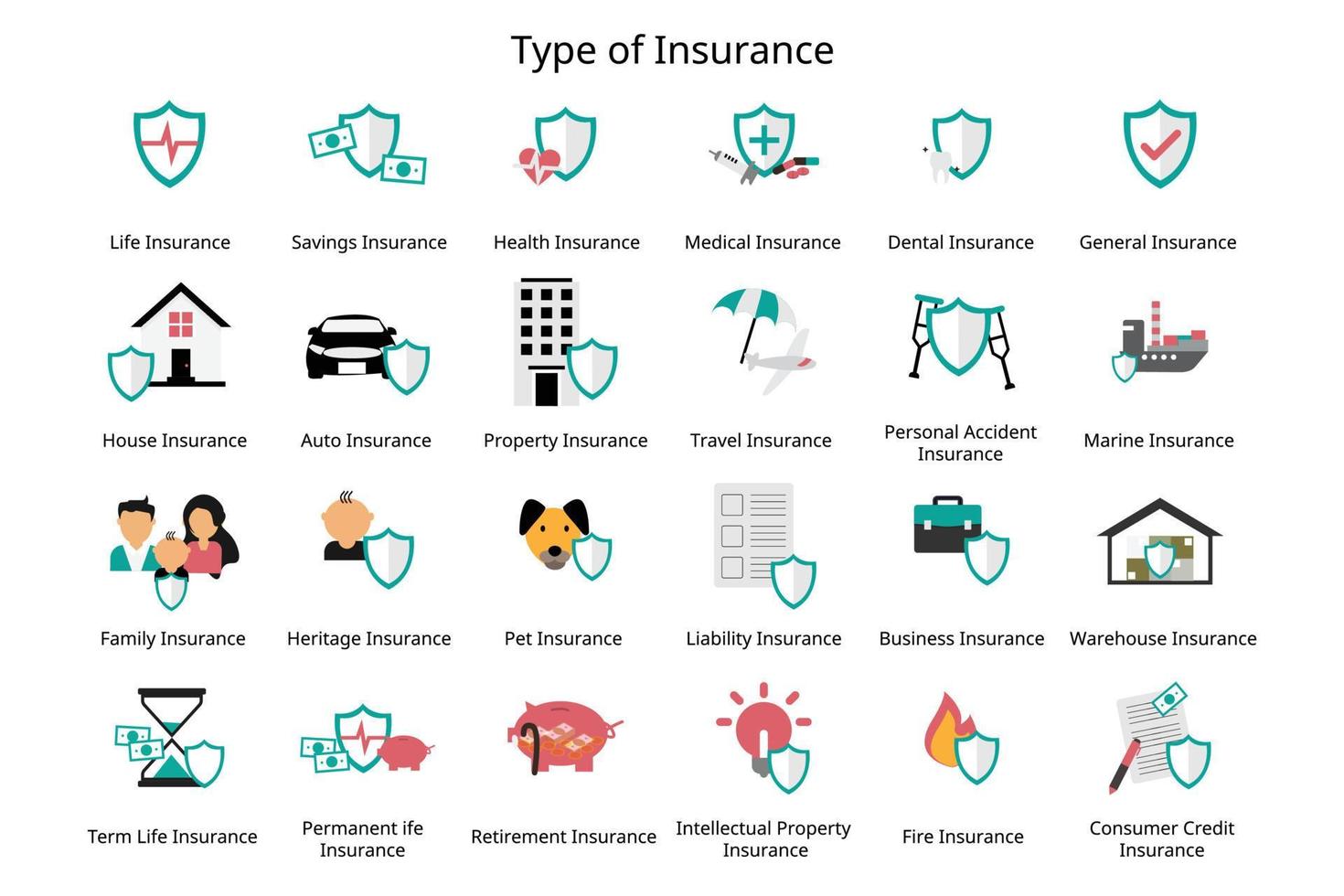

Ten essential insurance policies everyone should consider include health, life, auto, home, disability, long-term care, renters, umbrella, liability, and cyber insurance. These cover various risks, ensuring financial security and peace of mind.

Navigating the world of insurance can feel overwhelming, yet it’s crucial for safeguarding your future. Insurance policies protect you from unexpected financial burdens, whether due to health emergencies, accidents, or property damage. Understanding which policies are essential can help you make informed choices.

Each type of insurance addresses specific needs, from protecting your home to ensuring your family’s financial stability. Investing in these policies not only secures your assets but also provides a safety net during challenging times. Prioritizing the right insurance can lead to a more secure and stress-free life.

Introduction To Essential Insurance Policies

Insurance is vital for protecting your financial well-being. Understanding the essential insurance policies can save you from unexpected costs. Everyone faces risks in life. Having the right insurance can provide peace of mind. Here, we discuss the ten essential insurance policies everyone should consider.

Importance Of Being Insured

Being insured helps you manage risks effectively. It shields you from sudden financial burdens.

- Peace of Mind: Knowing you are covered eases stress.

- Financial Stability: Insurance prevents huge out-of-pocket expenses.

- Required by Law: Some insurances, like auto insurance, are mandatory.

How Insurance Protects You Financially

Insurance acts as a safety net in emergencies. Here’s how it helps:

- Medical Bills: Health insurance covers doctor visits and surgeries.

- Property Damage: Home insurance protects your home and belongings.

- Income Protection: Disability insurance replaces lost wages.

- Liability Coverage: Protects against lawsuits and claims.

Insurance policies vary. Each type serves a unique purpose. Choose wisely based on your needs.

Health Insurance: Guarding Your Well-being

Health insurance is vital for protecting your health and finances. It covers medical expenses and ensures you receive essential care. Without it, a sudden illness or injury can lead to overwhelming costs. Understanding health insurance empowers you to choose the best plan for your needs.

Components Of A Comprehensive Health Plan

A comprehensive health plan includes several key components. Here are the essential elements:

- Outpatient Care: Services that do not require an overnight stay.

- Emergency Care: Access to immediate medical attention.

- Hospital Stays: Coverage for necessary overnight treatments.

- Mental Health Coverage: Support for mental health services.

- Prescription Drug Coverage: Help with the cost of medications.

- Rehabilitation Services: Support for recovery after illness or injury.

- Lab Services: Tests and screenings for health assessments.

- Preventive Care: Free check-ups and vaccinations to maintain health.

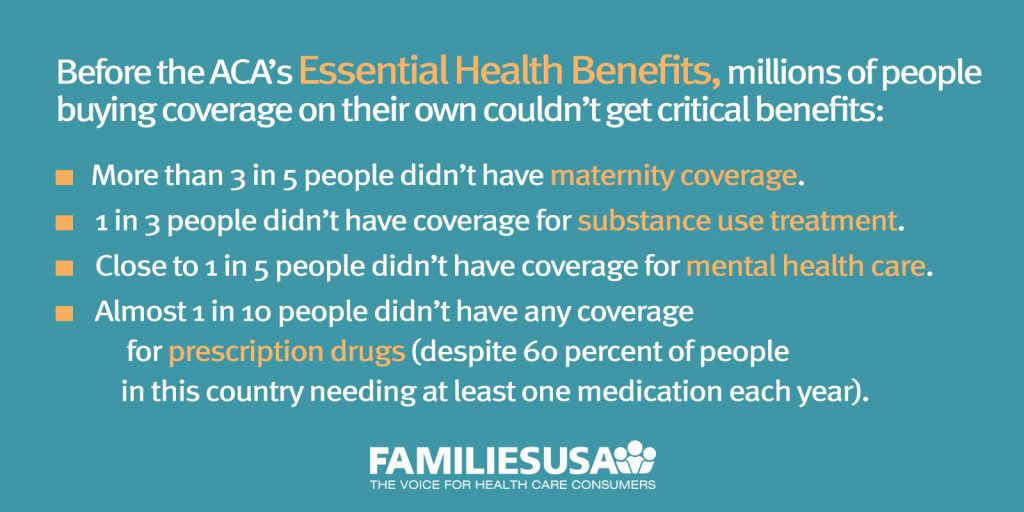

Understanding The Affordable Care Act

The Affordable Care Act (ACA) changed how health insurance works in the U.S. It aims to provide affordable coverage for everyone. Here are some key points about the ACA:

| Key Feature | Description |

|---|---|

| Individual Mandate | Requires most Americans to have health insurance. |

| Subsidies | Financial assistance for low and middle-income families. |

| Essential Health Benefits | Minimum coverage standards for all health plans. |

| Pre-existing Conditions | No denial of coverage due to prior health issues. |

| Marketplace | Online platform to compare and purchase plans. |

Understanding these features helps you make informed decisions about your health insurance.

credit: familiesusa.org

Auto Insurance: On And Off The Road

Auto insurance protects you from risks on and off the road. It covers accidents, theft, and other damages. Understanding its types helps you make informed choices. Choosing the right coverage is essential for peace of mind.

Liability Vs. Full Coverage

Choosing between liability and full coverage is crucial. Each offers different protections.

- Liability Insurance: Covers damages to others in an accident.

- Full Coverage: Includes liability and additional protections.

Full coverage typically covers:

- Collision damage

- Comprehensive damages

- Medical payments

- Uninsured motorist protection

Full coverage costs more but offers better security. Liability insurance is cheaper but limits your protection. Consider your driving habits and vehicle value before deciding.

Evaluating Auto Insurance Providers

Choosing the right auto insurance provider requires careful evaluation. Compare different companies to find the best fit for you.

| Criteria | Considerations |

|---|---|

| Coverage Options | Look for providers with flexible plans. |

| Customer Service | Check reviews for responsiveness and support. |

| Premium Rates | Compare quotes from multiple providers. |

| Discounts | Ask about multi-policy and safe driver discounts. |

Read customer reviews online. Seek recommendations from family and friends. Assess financial stability and claims process efficiency. Finding a reliable provider ensures a smooth experience during claims.

Homeowners And Renters Insurance: Your Safety Net

Homeowners and renters insurance acts as a crucial safety net for your home and belongings. It provides financial protection against various risks. Having the right policy ensures peace of mind. Whether you own a house or rent an apartment, insurance is essential.

Covering Property And Possessions

Homeowners and renters insurance covers your property and personal possessions. Here are the key aspects:

- Dwelling Coverage: Protects the structure of your home.

- Personal Property Coverage: Covers personal items like furniture and electronics.

- Liability Protection: Offers financial protection against lawsuits.

Policies vary, so it’s wise to review what each covers. Consider how much coverage you need based on your possessions.

Dealing With Natural Disasters And Theft

Natural disasters and theft can happen unexpectedly. Insurance helps manage these risks:

| Risk | Insurance Coverage |

|---|---|

| Flood | Requires separate flood insurance. |

| Fire | Typically covered under most policies. |

| Theft | Covered if items are stolen from your home. |

| Earthquake | Requires separate earthquake insurance. |

Evaluate your risks based on your location. Consider additional coverage for specific threats.

Life Insurance: Securing Your Family’s Future

Life insurance is crucial for protecting your family’s financial future. It provides peace of mind, knowing your loved ones are taken care of. Whether you have a mortgage, kids, or dependents, life insurance is essential. It ensures they won’t struggle financially in your absence.

Term Vs. Permanent Life Insurance

Choosing between term and permanent life insurance can be confusing. Here’s a simple breakdown:

| Type | Duration | Premiums | Cash Value |

|---|---|---|---|

| Term Life Insurance | Specific period (10, 20, 30 years) | Generally lower | No cash value |

| Permanant Life Insurance | Lifetime coverage | Generally higher | Builds cash value |

Term life insurance is affordable and straightforward. It covers you for a set time. Permanent life insurance lasts your entire life. It also builds cash value over time, but costs more.

Calculating Your Coverage Needs

Determining the right amount of coverage is vital. Here’s how to calculate your needs:

- Debt: Add your outstanding debts (mortgage, loans).

- Income: Multiply your annual income by the number of years you want to cover.

- Expenses: Estimate your family’s living expenses for the next few years.

- Education: Include future education costs for your children.

Use this formula:

Coverage Amount = Debt + Income + Expenses + Education

Review your calculations every few years. Life changes can affect your coverage needs. Always adjust your policy accordingly.

Disability Insurance: Income Protection

Disability insurance is essential for safeguarding your income. It provides financial support if you cannot work due to an illness or injury. Many people underestimate the risk of becoming disabled. Yet, it can happen to anyone at any time. Having this insurance gives peace of mind and protects your financial future.

Short-term Vs. Long-term Disability

Understanding the difference between short-term and long-term disability insurance is crucial. Here’s a quick overview:

| Feature | Short-Term Disability | Long-Term Disability |

|---|---|---|

| Coverage Duration | Up to 6 months | More than 6 months |

| Waiting Period | Usually 1-2 weeks | Typically 30-90 days |

| Payout Percentage | 60-70% of income | 50-70% of income |

| Common Causes | Temporary injuries or illnesses | Chronic illnesses or severe injuries |

Short-term disability insurance covers immediate needs. Long-term disability insurance supports you for extended periods. Both types are vital for complete protection.

The Role Of Disability Insurance In Your Financial Plan

Disability insurance plays a key role in financial planning. It ensures that you can pay your bills even if you can’t work. Here’s why it matters:

- Income Replacement: Helps cover lost wages.

- Peace of Mind: Reduces stress about finances.

- Protect Savings: Prevents draining savings accounts.

- Maintain Lifestyle: Keeps your standard of living intact.

Assess your needs carefully. Consider your expenses and income sources. Choose a policy that fits your lifestyle. Remember, the goal is to secure your financial future.

Long-term Care Insurance: Preparing For The Golden Years

As people age, the likelihood of needing assistance with daily activities increases. Long-term care insurance helps cover the costs associated with this care. Planning for these expenses early can protect your savings and ensure you receive the care you deserve. Many individuals overlook this essential policy until it’s too late. Understanding the significance of long-term care insurance can lead to better financial security in your golden years.

Costs And Benefits Of Long-term Care

Long-term care insurance comes with various costs and benefits. Here’s a quick overview:

| Costs | Benefits |

|---|---|

| Monthly premiums vary by age and health. | Covers nursing home and in-home care. |

| Premiums increase with age. | Protects savings from depleting. |

| Some policies have waiting periods. | Offers peace of mind for family. |

Investing in long-term care insurance can save you from unexpected costs. It provides financial relief during challenging times. Without coverage, families may face overwhelming expenses.

When To Consider Buying Long-term Care Insurance

Timing is crucial when purchasing long-term care insurance. Here are key factors to consider:

- Age: Best to buy between 50 and 65.

- Health: Pre-existing conditions may affect eligibility.

- Financial Situation: Assess your savings and assets.

- Family History: Consider your family’s health history.

Buying early can lower premiums. Waiting too long may result in higher costs or denial. Make informed decisions to secure your future.

Umbrella Insurance: Extra Liability Coverage

Umbrella insurance provides an extra layer of protection beyond your standard policies. It covers liability claims that exceed the limits of your home, auto, or boat insurance. This type of insurance is crucial for safeguarding your assets from unexpected events.

Many people underestimate the importance of umbrella insurance. It can protect you from lawsuits, accidents, or damages that might otherwise lead to significant financial loss. A single incident can quickly exceed the limits of your primary policies. Umbrella insurance steps in to fill that gap.

How Umbrella Insurance Works

Umbrella insurance works as follows:

- It provides additional coverage beyond your current policies.

- It kicks in after your standard policy limits are reached.

- It covers various incidents, including:

- Injuries to others

- Property damage

- Legal fees from lawsuits

For example, if you cause an accident resulting in $500,000 in damages, but your auto insurance only covers $300,000, your umbrella policy can cover the remaining $200,000.

Who Needs Umbrella Insurance?

Consider umbrella insurance if you meet any of these criteria:

- You have significant assets to protect.

- You own a home or rental property.

- You have a high net worth.

- You have teenage drivers in your household.

- You engage in activities that could lead to lawsuits, like hosting events.

Even those without significant assets can benefit. A single incident can lead to costly legal battles. Umbrella insurance can provide peace of mind for anyone concerned about liability risks.

| Benefits of Umbrella Insurance | Considerations |

|---|---|

| Protects against large claims | May require existing liability policies |

| Covers legal defense costs | Not all incidents are covered |

| Affordable premiums | Minimum coverage limits apply |

Cyber Insurance: Protecting Your Online Presence

In today’s digital age, cyber insurance is crucial for individuals and businesses. It helps protect against online risks. From data breaches to cyberattacks, the threats are real. Understanding this insurance can save you from financial disaster.

Risks In The Digital World

The internet offers many benefits but comes with significant risks. Here are some common cyber risks:

- Data Breaches: Unauthorized access to sensitive information.

- Cyberattacks: Deliberate attempts to disrupt services.

- Phishing: Fraudulent attempts to obtain personal information.

- Ransomware: Malicious software that blocks access to data until a ransom is paid.

The Growing Need For Cyber Insurance

The demand for cyber insurance is increasing rapidly. Here are some reasons:

- Rising Cyber Threats: More attacks are happening each year.

- Regulatory Requirements: Many industries require data protection.

- Financial Losses: Cyber incidents can lead to significant costs.

- Reputation Damage: A breach can harm your brand image.

Investing in cyber insurance offers peace of mind. It helps businesses recover quickly from attacks. Coverage can include:

| Coverage Type | Description |

|---|---|

| Data Breach Response | Support for managing and notifying affected parties. |

| Business Interruption | Compensation for lost income during recovery. |

| Legal Fees | Coverage for defense costs and settlements. |

In summary, cyber insurance is vital in today’s digital landscape. Protect your online presence and secure your future.

Specialized Insurance Policies To Consider

Specialized insurance policies offer protection for unique situations. These cover specific risks that standard policies may not. Understanding these policies can help you make informed decisions. Here are three essential specialized insurance types to consider.

Travel

Travel insurance is crucial for frequent travelers. It covers unexpected events during trips. Here are key benefits:

- Trip Cancellation: Reimburse non-refundable costs.

- Medical Emergencies: Covers health issues abroad.

- Lost Luggage: Replaces lost or delayed baggage.

Travel insurance provides peace of mind. It ensures safety while you explore new places.

Pet

Pet insurance protects your furry friends. Veterinary bills can be high. Here are important features:

- Accident Coverage: Helps with emergency treatments.

- Illness Protection: Covers common health issues.

- Wellness Plans: Offers routine care options.

Investing in pet insurance keeps your pet healthy. It can save you money in the long run.

Flood Insurance

Flood insurance is vital for homeowners in flood-prone areas. Standard home insurance often doesn’t cover floods. Consider these points:

- Coverage for Damage: Protects against water damage.

- Replacement Costs: Reimburses for lost belongings.

- Available for Renters: Covers personal property too.

Flood insurance can be a lifesaver. It provides security during unexpected weather events.

Assessing Niche Insurance Needs

Understanding your unique insurance needs is crucial. Here are steps to evaluate your requirements:

- Identify potential risks in your life.

- Consider your assets that need protection.

- Research specialized policies that fit your needs.

- Compare quotes from different providers.

Assessing niche insurance can save you money and stress. Make informed choices for better coverage.

Choosing The Right Insurance Policies

Finding the right insurance policies is crucial for protecting your assets and ensuring peace of mind. With many options available, it can be overwhelming. Understanding your needs helps you make informed decisions. Here are key factors to consider when selecting the best insurance for you.

Comparing Policy Features And Prices

When evaluating insurance policies, consider both features and prices. Comparing these elements helps you find the best fit for your needs.

| Insurance Type | Key Features | Average Cost |

|---|---|---|

| Health Insurance | Doctor visits, hospital stays, prescriptions | $300 – $600/month |

| Auto Insurance | Liability, collision, comprehensive coverage | $100 – $250/month |

| Homeowners Insurance | Property damage, liability, theft protection | $700 – $1,500/year |

| Life Insurance | Term, whole life, universal life | $20 – $50/month |

Follow these steps to compare policies:

- List your required coverage.

- Gather quotes from multiple providers.

- Check the limits and deductibles.

- Read customer reviews.

Working With Insurance Agents

Insurance agents can guide you through the selection process. They help clarify your options and recommend policies based on your needs.

- Expert Advice: Agents have experience in the insurance field.

- Policy Customization: They can tailor policies to fit your lifestyle.

- Claims Assistance: Agents assist you during the claims process.

Choose an agent who understands your specific requirements. Ask questions to ensure you receive the best service. This partnership can ease the stress of choosing the right insurance.

Maintaining And Reviewing Your Insurance Portfolio

Keeping your insurance portfolio up-to-date is crucial. Life changes often require adjustments in your coverage. Regular reviews ensure you are adequately protected. Policies may become outdated as your needs evolve.

Regular Policy Checkups

Performing regular checkups on your insurance policies is essential. Schedule a review at least once a year. This review can help identify gaps in coverage.

- Check for changes in your personal circumstances.

- Assess your current coverage limits.

- Review any new insurance products available.

- Ensure your premiums align with your budget.

Adjusting Coverage As Life Changes

Your life is dynamic. Major events can affect your insurance needs. Consider these life changes:

| Life Event | Insurance to Review |

|---|---|

| Marriage | Life Insurance, Health Insurance |

| Having Children | Life Insurance, Homeowners Insurance |

| Buying a Home | Homeowners Insurance, Flood Insurance |

| Job Change | Health Insurance, Disability Insurance |

| Retirement | Life Insurance, Long-Term Care Insurance |

Update your policies based on these changes. Don’t wait for renewal time. Regular adjustments can save you money and ensure better coverage.

Credit: m.facebook.com

Frequently Asked Questions

What Are The 10 Essential Health Benefits That The Aca Considered Required Coverage?

The ACA mandates ten essential health benefits: 1. Outpatient care 2. Emergency services 3. Hospitalization 4. Maternity and newborn care 5. Mental health services 6. Prescription drugs 7. Rehabilitative services 8. Laboratory services 9.

Preventive services 10. Pediatric services These ensure comprehensive coverage for all individuals.

What Are 10 Things You Absolutely Need To Know About Life Insurance?

1. Understand different types: term, whole, and universal life insurance. 2. Assess your coverage needs based on dependents and debts. 3. Compare quotes from various insurers for the best rates. 4. Check the insurer’s financial stability and customer reviews. 5.

Review your policy regularly as life circumstances change. 6. Know the exclusions and limitations of your policy. 7. Consider riders for additional benefits, like critical illness. 8. Ensure premiums fit within your budget. 9. Use an insurance agent for personalized guidance.

10. Make beneficiaries aware of the policy details.

What Are The 10 Ehbs?

The 10 Essential Health Benefits (EHBs) include: 1. Outpatient care 2. Emergency services 3. Hospitalization 4. Maternity and newborn care 5. Mental health services 6. Prescription drugs 7. Rehabilitative services 8. Laboratory services 9. Preventive services 10. Pediatric services

What Are The 4 Most Important Insurances?

The four most important insurances are life insurance, health insurance, auto insurance, and long-term disability insurance. These protect your financial stability, health, and assets in unforeseen circumstances. Prioritizing these coverages ensures comprehensive protection for you and your loved ones.

Conclusion

Choosing the right insurance policies is crucial for financial security. Each type serves a specific purpose, protecting you from unexpected events. By assessing your needs and comparing options, you can ensure comprehensive coverage. Don’t wait until it’s too late; start evaluating your insurance today to secure your peace of mind for tomorrow.